About the Checkoff

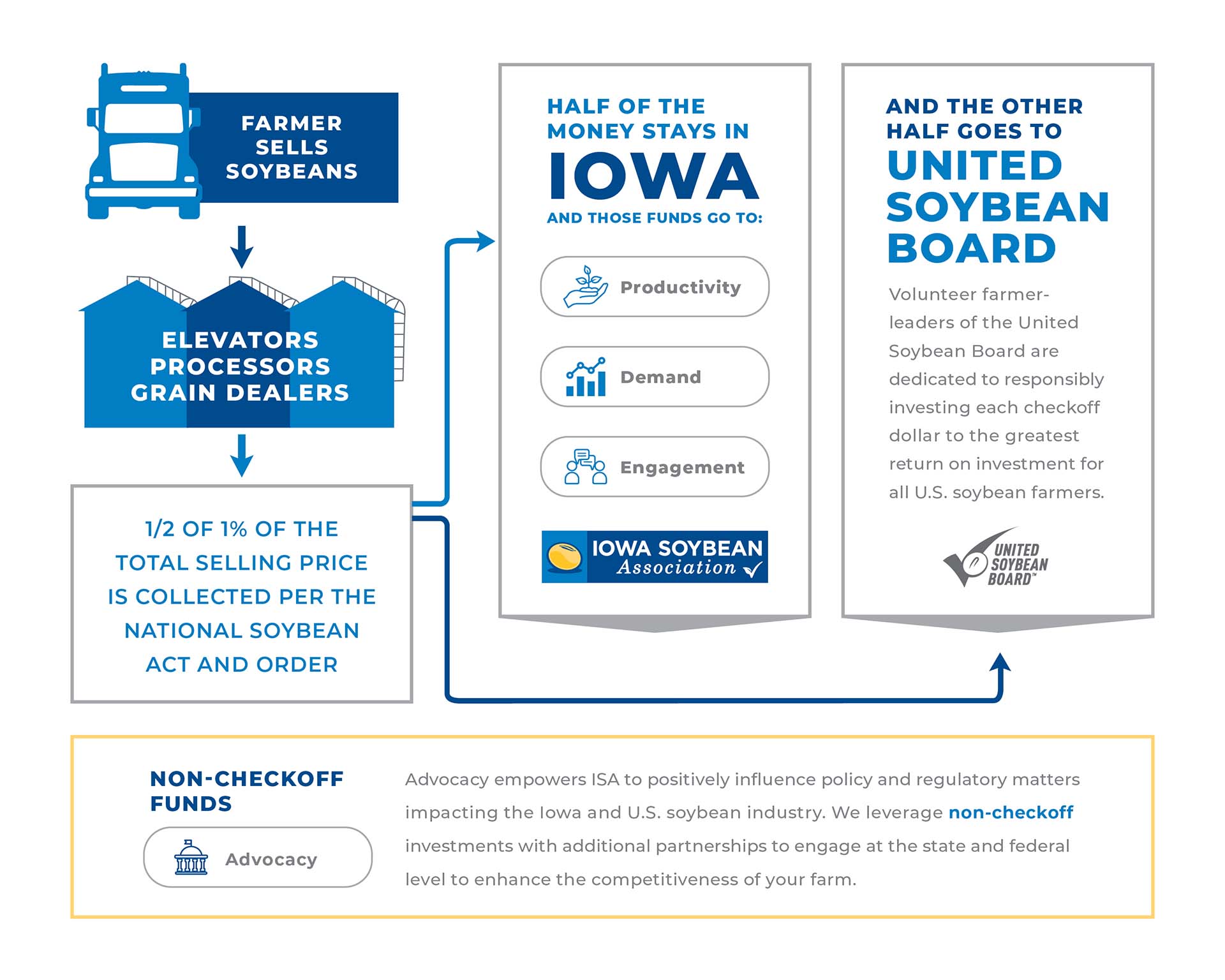

The Soybean Promotion, Research, and Consumer Information Act established the national soybean checkoff program in 1990. The Department of Agriculture established the United Soybean Board, a farmer-led organization, to administer the program on a national level.

Many soybean growing states also have a Qualified State Soybean Board (QSSB) charged with collecting and administering the checkoff on a state level. In Iowa, the Iowa Soybean Board (ISB) serves as the states QSSB.