.jpg)

Rick Juchems, an ISA district director, and other farmers are happy with the record soybean sales during the current marketing year. (Photo: Joseph L. Murphy/Iowa Soybean Association)

Soybean exports outpacing record

February 11, 2021 | Bethany Baratta

Crops delays in South America and strong export sales, specifically to China, are boosting soybean sales to record levels this marketing year.

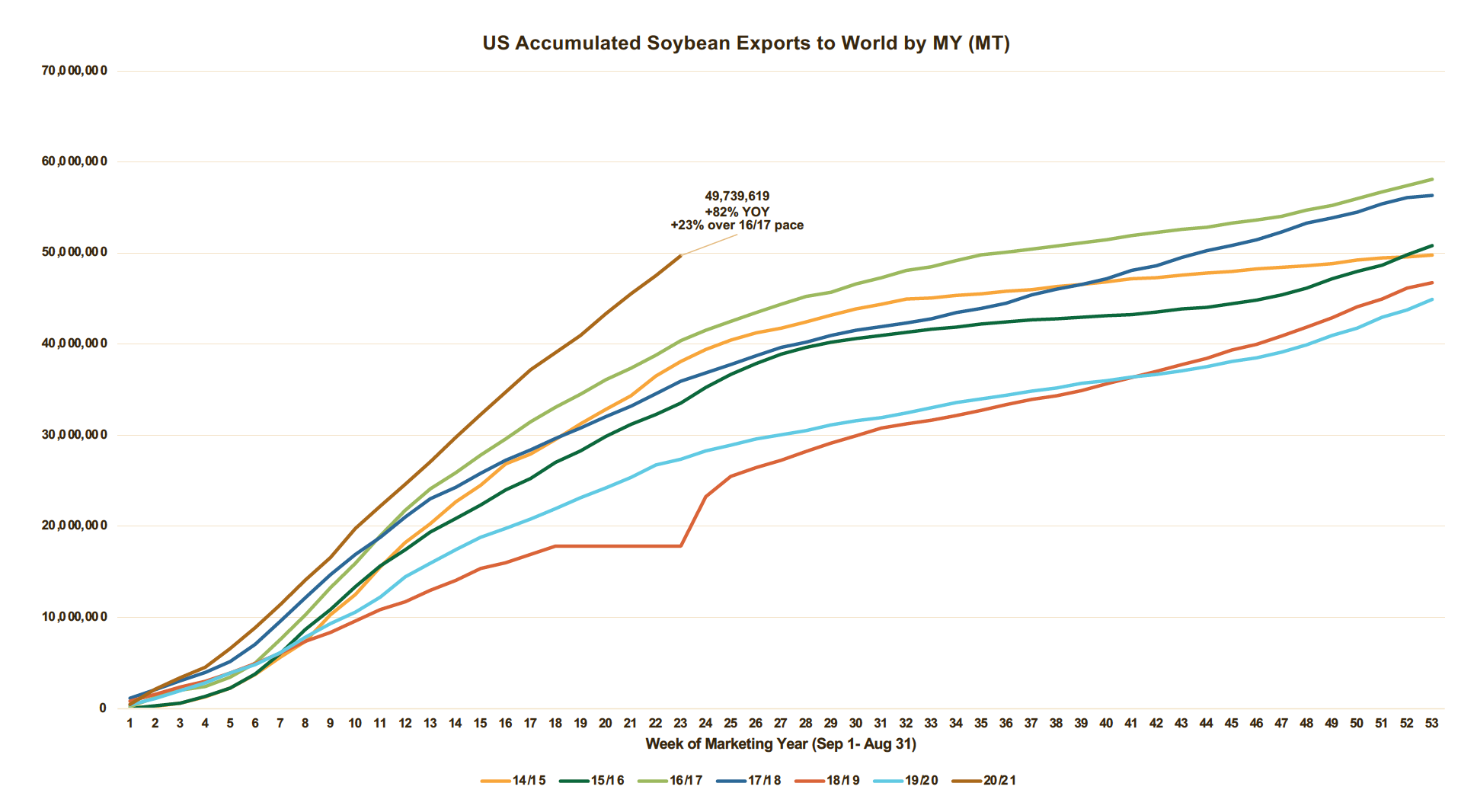

The pace of sales is outpacing the record 2016-2017 marketing year, says Mac Marshall, vice president of market intelligence for the U.S. Soybean Export Council (USSEC) and United Soybean Board (USB).

Sales data through Feb. 4 show sales of 49.7 million metric tons (1.83 billion bushels) and outstanding sales of another 9.7 million metric tons (357 million bushels) for a total of 59.5 million metric tons.

That’s up from the 2016-2017 marketing year when combined sales and commitments were 50.8 million tons at this stage of the marketing year. Soybean export sales finished at a record 59 million metric tons in the 2016-2017 marketing year.

In the latest World Agricultural Supply and Demand Estimates (WASDE) report, the USDA increased its forecast of soybean exports by 20 million bushels to 2.25 billion bushels.

With the strength in recent sales, Marshall says it’s achievable.

“We’re on pace to achieve that where we are right now,” Marshall says. “We typically don’t see upwards of 95% of USDA’s projected sales already committed for the year.”

The strength in sales is good news for farmers like Rick Juchems near Plainfield.

“It’s added dollars to the market and that was the best thing we could get,” says Juchems, an Iowa Soybean Association (ISA) district 3 director.

Data Sources: US FAS Export Sales through Week Ending February 4, 2021

Data Sources: US FAS Export Sales through Week Ending February 4, 2021

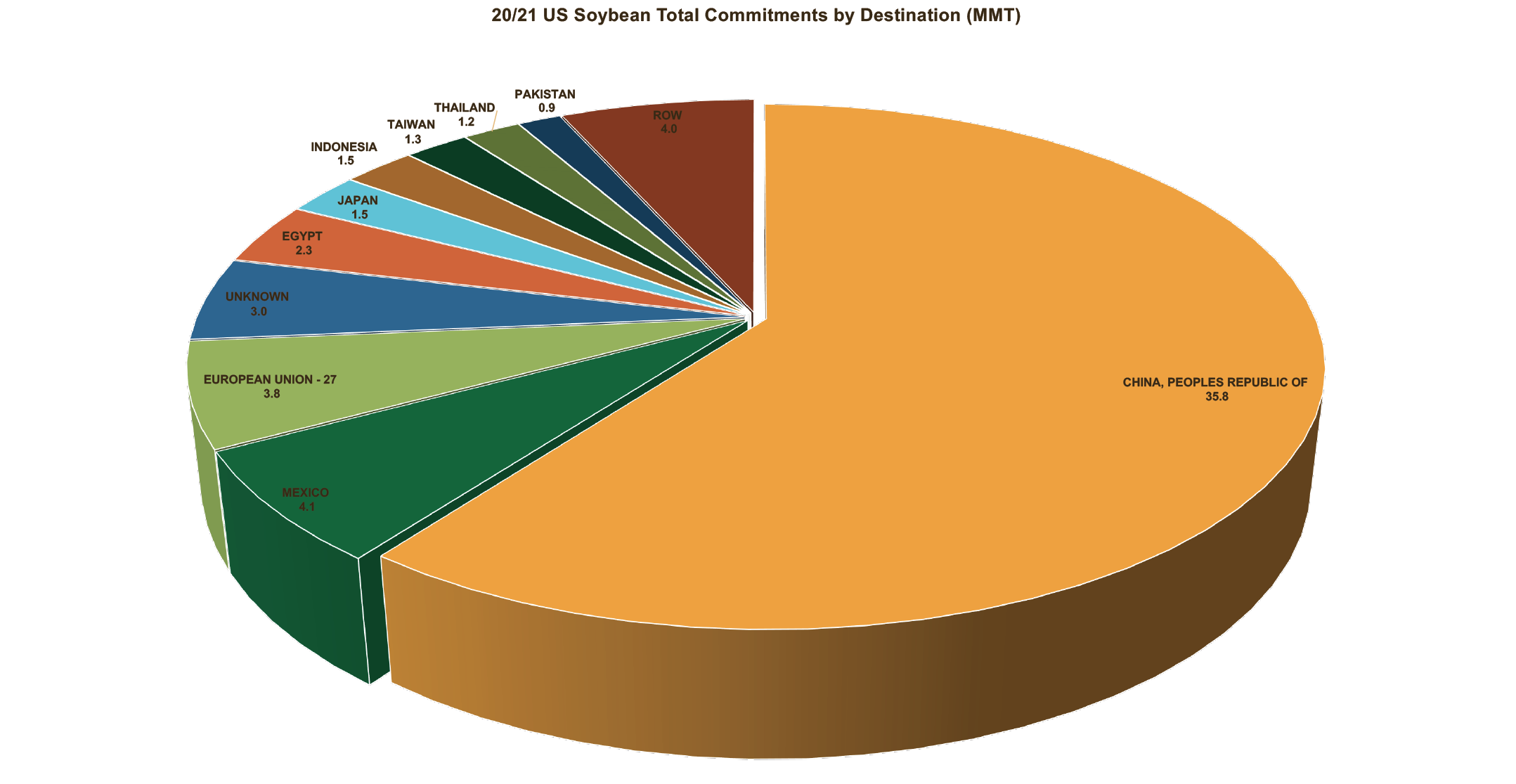

China

At the top of the list in export sales: China. Nearing the one-year anniversary (Feb. 14) of the entry into force of the Phase 1 trade agreement between the United States and China, soybean exports to China have eclipsed 33.5 million metric tons and another 2.3 million metric tons in outstanding sales. Combined, China has committed to purchasing 35.8 million metric tons from the United States.

U.S. soybean exports to China following the entry into the Phase 1 agreement (between mid-February and the end of the 2019/20 marketing year) totaled 4.5 million metric tons.

“We’re seeing China coming back into the marketplace,” Marshall says.

He noted that the enforcement of the Phase 1 deal came after the typical U.S. soybean sales push before South American soybeans are harvested.

“The 20/21 marketing year is really the first season where the U.S. can take full advantage of the Phase 1 agreement being entered into force,” Marshall says.

Growth in soybean sales to Egypt, Vietnam and other trading partners have also expanded soybean sales so far this marketing year.

“The preference for U.S. soy is prevailing in a lot of our major trading partners,” Marshall says.

Data Source: US FAS Export Sales through Week Ending February 4, 2021. Prior year is through February 6, 2020.

Data Source: US FAS Export Sales through Week Ending February 4, 2021. Prior year is through February 6, 2020.

(ROW = Rest Of World)

South American soybeans

Pre-report estimates pegged Argentine and Brazilian soybean crops to be pegged lower in the February WASDE report because of adverse weather and a slower harvest pace (near 5% last week). The USDA, however, left the Argentine soybean crop at 48 million metric tons and Brazil at 133 million metric tons.

“I was a little surprised to see the Argentina and Brazil soybean crops unchanged but given the slower harvest pace I think the wait-and-see approach to these forecasts are warranted,” Marshall says.

Depending on harvest weather and progress, the USDA could still update the productions forecast in the March 11 WASDE report.

Weather delays have pushed out the South American crop, providing a longer window for the United States to ship soybeans to trading partners.

In contrast, Brazil shipped 1.5 million metric tons of soybeans in January last year. This year, 80,000 metric tons were shipped, according to Refinitiv data.

Planting intentions

Given higher exports and unchanged soybean crush, ending stocks were reduced 20 million bushels to 120 million bushels. If realized, soybean ending stocks would be down 77% from 2019/20, and the lowest since 2013/14 when carryout was 92 million bushels. It puts stocks to use at 2.6%, or just 10 days’ worth of stocks available for use.

The supply squeeze supports higher prices and could reflect higher soybean acres in the U.S., Marshall says.

He noted that the $13-14 per bushel soybeans farmers saw in 2014 also reflected a tighter soybean supply. Higher prices also encouraged farmers to plant a large number of acres to soybeans.

“It was the first time the United States crossed 80 million acres of planted soybeans,” Marshall said. “There was a lot of price signals to bring more soybeans to the marketplace.”

Could that play out this year?

Yes, but price signals are strong for both soybeans and corn, so there could be more acres of both, Marshall says.

For Juchems, 2021 planting intentions will follow his rotation.

“I’ll follow my rotation this year, about 50-50 corn and soybeans,” Juchems says. “Most of the farmers I talk to say they’ll do the same this year.”

The USDA will release its planting intentions report on March 31.

Back