Reduced land and seed costs relative to U.S. production consistently push Brazilian soybean prices lower than U.S. prices (Photo: American Soybean Association)

U.S. soybean farmers sound alarm as China turns to Brazil amid trade standoff

August 21, 2025 | Bethany Baratta

In a letter to President Donald Trump earlier this week, American Soybean Association president Caleb Ragland urged the importance of reaching a deal with China that includes the removal of China’s retaliatory duties and significant soybean purchase commitments.

“U.S. soybean farmers are standing at a trade and financial precipice,” says Ragland, a farmer from Magnolia, Ky.

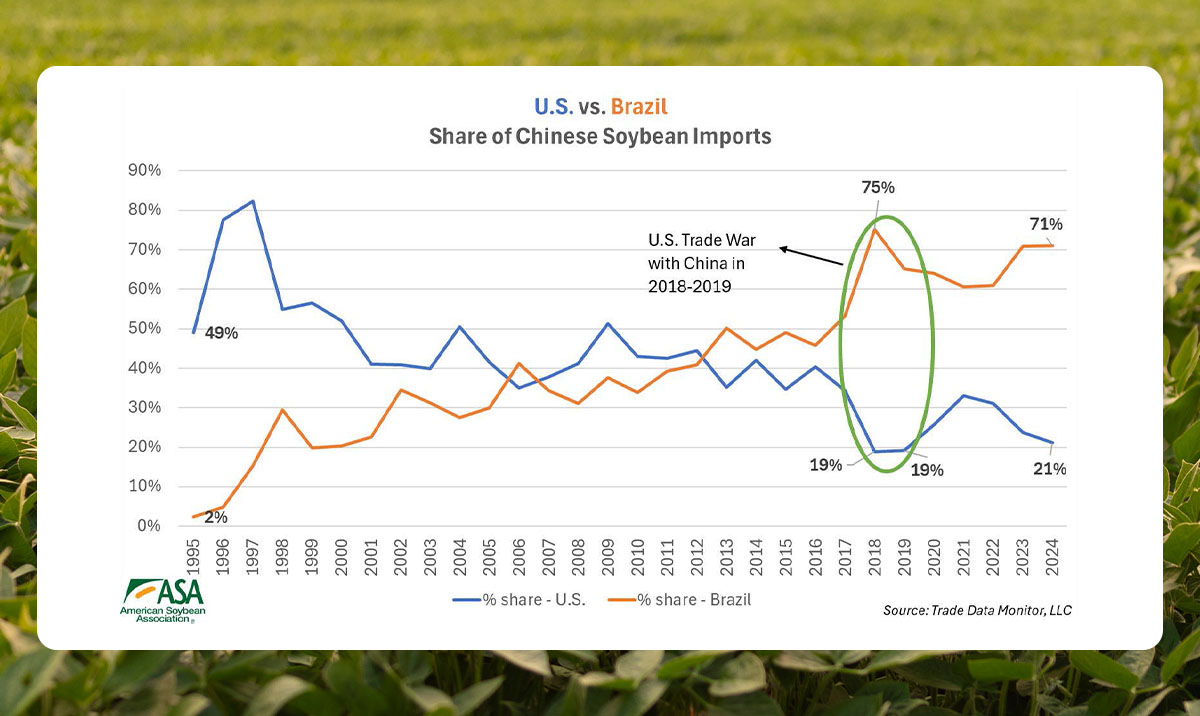

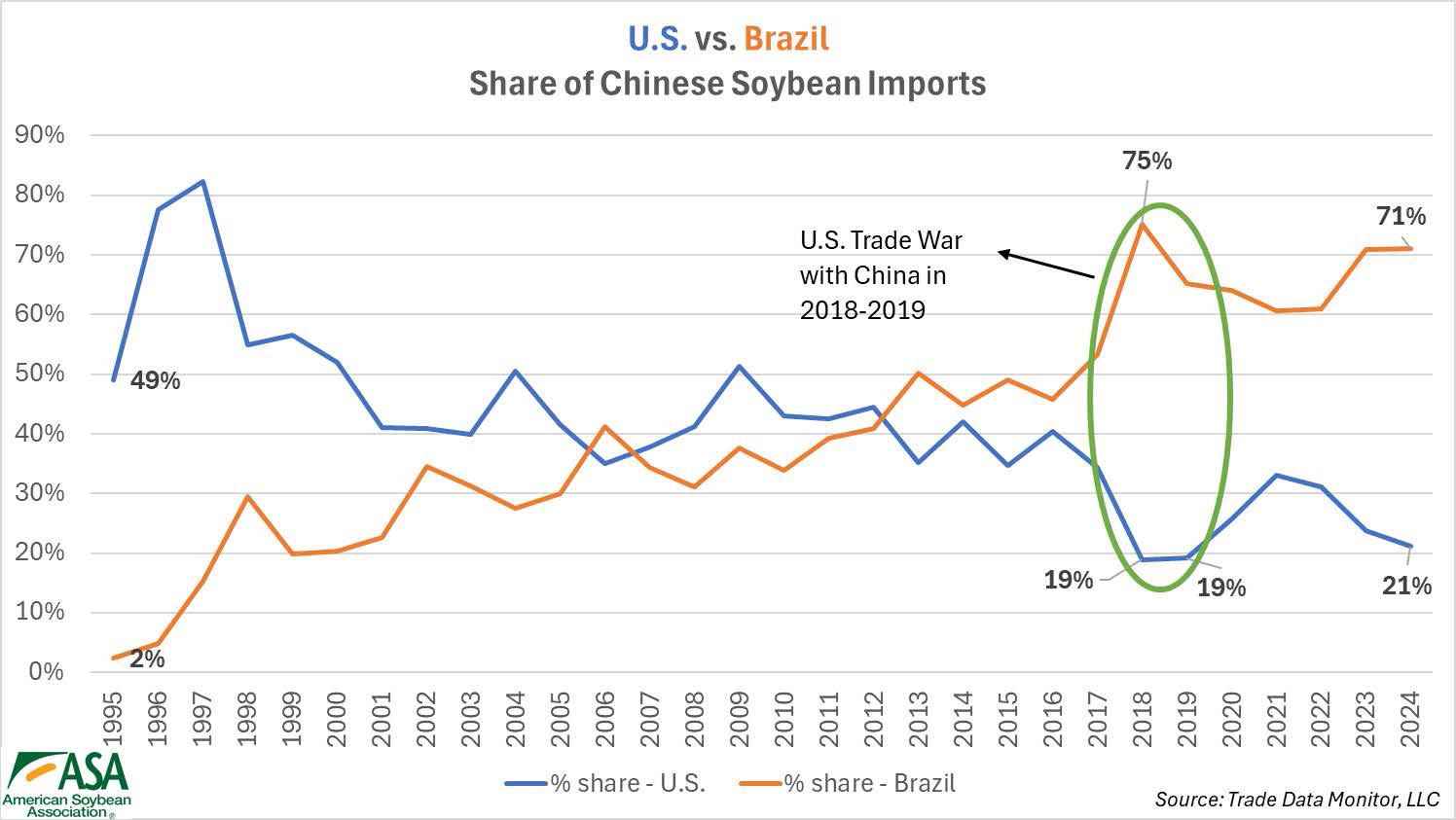

Over the past five years, China has imported an average of 61% of the world’s available soybean supplies – more than the rest of the world combined. Historically, the U.S. was the provider of choice for Chinese customers. However, due to ongoing tariff retaliation, our longstanding customers in China have and will continue to turn to our competitors in South America to meet their demand, a demand Brazil can meet due to significantly increased production since the previous trade war with China.

China’s absence from the new crop export market has dealt a heavy blow to U.S. soybean futures prices, especially as favorable U.S. growing conditions this summer will lead to above-trendline soybean yields to be produced in the 2025 crop year, which begins Sept. 1.

“U.S. soybean farmers cannot survive a prolonged trade dispute with our largest customer,” says Ragland, noting a 51-cent price drop between July 18 and Aug. 6 on new crop November 2025 soybean futures.

When compared to an expected national average cost of $12.05 per bushel, this price drop pushes soybean farmers deeper into the red in an already difficult year.

A report from the American Soybean Association confirms the lost market share to Brazil. Reduced land and seed costs relative to U.S. production consistently push Brazilian soybean prices lower than U.S. prices, making Brazilian soybean shipments more affordable for the top global buyer, China. As a result, China’s soybean purchases from Brazil ballooned over the past 15 years while imports of U.S. soybeans began to decline. As China’s soybean purchases from Brazil grew, the lower costs, favorable currency exchange rates and additional infrastructure investments from China expanded profits for Brazilian producers, pushing more soybean acres into production in Brazil. USDA projects Brazil produced 42% more soybeans than the U.S. in marketing year 2024/25, supplying its export market with 112 million metric tons, which is an equivalent volume to China’s marketing year 2024/25 imports that also totaled 112 million metric tons.

“Unfortunately for our soybean growers, China has contracted with Brazil to meet future months’ needs to avoid purchasing any soybeans from the United States,” Ragland says.

U.S. soybeans currently face a duty 20% higher than soybeans from South America due to Chinese retaliatory tariffs.

“That puts our farmers at an untimely competitive disadvantage. China has not purchased any U.S. soybeans for the months ahead as we quickly approach harvest,” he says. “The further into the autumn we get without reaching an agreement with China on soybeans, the worse the impacts will be on U.S. soybean farmers.”

Reduced land and seed costs relative to U.S. production consistently push Brazilian soybean prices lower than U.S. prices, making Brazilian soybean shipments more affordable for top global buyer China. As a result, China’s soybean purchases from Brazil ballooned over the past 15 years while imports of U.S. soybeans began to decline. Source: American Soybean Association.

View the report here.

View the letter here.

Written by Bethany Baratta.

Back