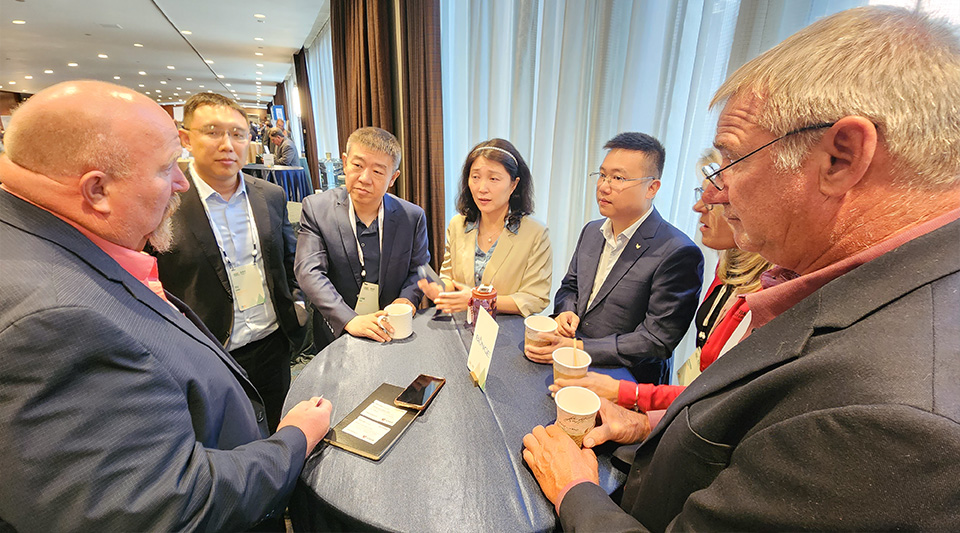

(Photo: Iowa Soybean Association / Aaron Putze)

New York center of soy universe for USSEC global forum

November 1, 2023 | Aaron Putze, APR

When making the case (and sale) for your version of a product that numbers in the billions, differentiation is key.

For U.S. farmers, it’s the quality of the soybeans they produce that sets them apart from the global competition.

“As a farmer, I take pride in growing high-quality soybeans because that’s what buyers are looking for,” says Tom Adam of Harper.

The southeast Iowa farmer and Iowa Soybean Association director made his pitch to processors, traders and buyers during the U.S. Soybean Export Council’s (USSEC) Global Soy Forum held recently in New York City.

Harper was busy as more than 700 people representing 60 countries attended the two-day meeting and sought conversations with farmers.

“Soy value chain stakeholders want to hear from multi-generational farmers like Tom,” said USSEC CEO Jim Sutter. “They want to know the specific ways U.S. farmers sustainably produce a quality and reliable soybean crop.”

Exporting soy to destinations around the world drives demand and strengthens domestic market prices.

U.S. soybean exports were valued last year at more than $34 billion, according to the U.S. Department of Agriculture’s Foreign Ag Service (FAS). That’s up 26% from the previous year and nearly 30% from 2020. Total U.S. ag exports were valued at just shy of $200 billion.

Alexis Taylor, U.S. Department of Agriculture’s undersecretary of trade and foreign agricultural affairs, says U.S. soybean farmers “stand ready” to serve the needs of consumers around the world.

“We saw gains last year in agricultural sales to all top-10 U.S. customers,” Taylor says.

The ag trade official added that there were 30 markets around the world where U.S. exports totaled more than $1 billion, up from 27 markets the previous year.

“Soy plays a big, big factor in this growth,” Taylor added.

China bought $17.8 billion of U.S. soy in 2022 compared to $14.1 billion in 2021, a 27% increase. According to FAS data, Mexico, the European Union and Egypt rounded out the top-four buyers of U.S. soy in 2022 with purchases of $3.6, $2.7 and $2 billion respectively.

Brazil accounts for 60% of global soy market share compared to a U.S. share of 28-38%. Combined, Brazil and U.S. supplies 90% of global soy inventories.

Argentina competes for global soybean meal sales, but volumes have suffered the past 2-3 years due in part to crippling droughts and economic woes.

The Brazil-U.S. soy dominance is here to stay, says Walter Cronin, an oilseed processing consultant.

“There is no country on the way to challenge Brazil and the United States on production of the world’s most consumed protein,” he says.

U.S. exports of soy will decline in the coming years, Cronin predicts, as the world’s reliance on Brazil increases beyond 60% of global share.

Argentina’s global soybean meal market share will decline from 50% to 35% over the coming decade. Driving the decline will be more competitively priced U.S. soybean meal as crushers ramp up to satisfy surging demand for oil needed for renewable fuels.

As U.S. farmers top off the bins after another busy harvest season, all eyes are on the economic and social health of China, the world’s top soy consumer.

Jahangir Azis, who researches global market economies for J.P. Morgan, says lockdowns caused by Covid, serious amounts of internal regulatory changes and massive intensification of U.S. sanctions have rocked China’s economy.

Adding to the misery is China’s vanishing real estate market and prioritizing state-owned enterprises over the private sector. Combined, they create enormous negative vibes that have global repercussions.

Earlier this year, India surpassed China as the world’s most populous and looks to widen its lead over the coming decades.

As India struggles to implement economic reforms to mesh with its exploding population, China will continue to look to Brazil and the U.S. for soy. Export sales to the country of $1.4 billion grow even brighter if its hog herd recovers from African Swine Fever outbreaks.

“For global exporters, the Chinese demands have been clear — they want to be connected to farmers and infrastructure and logistics providers,” Cronin says. In the meantime, it’s likely the bulk of these sales will be made by Brazil while the U.S. becomes the world’s go-to supplier of high-quality and competitively priced soybean meal.

Back