American Soybean Association Chief Economist Scott Gerlt (pictured) was one of the panelists during the 99th Ag Outlook Forum's grains and oilseeds outlook panel. (File photo/Photo credit: Joseph Hopper/Iowa Soybean Association)

Ag Outlook panel’s picks 2023's biggest challenges

March 8, 2023

99th Ag Outlook’s oilseed breakout session examines what’s growing, where it’s going and the forecast

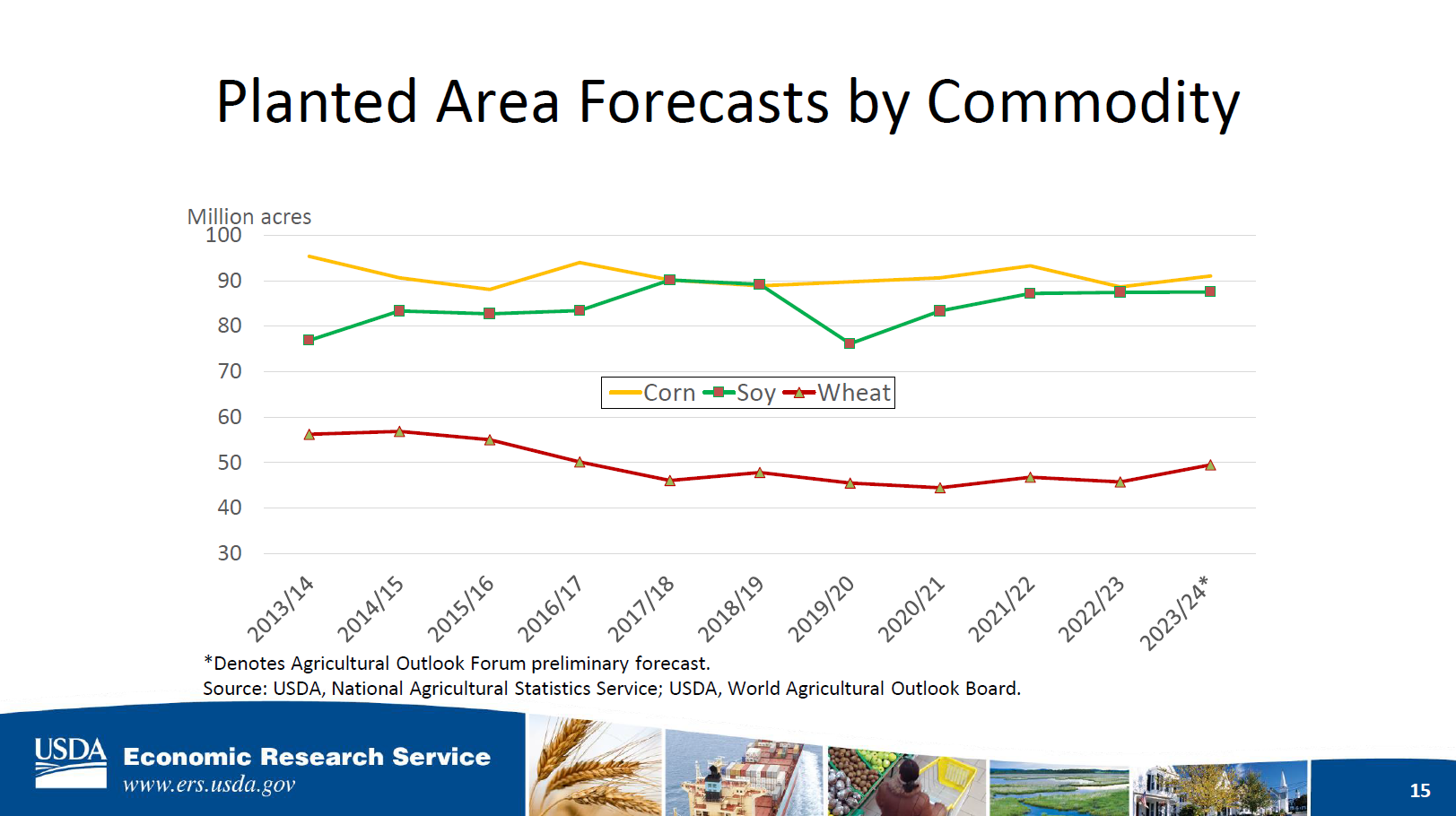

Kicking off the 99th Ag Outlook Forum’s oilseeds outlook panel, USDA Economic Research Service Economist Andrew Sowell named the key factors expected to affect grains and oilseeds in 2023: tight supplies, input costs, high interest rates, a strong U.S. dollar and the weather. When it comes to soybeans, Sowell says soybean prices have firmed and expected U.S. soybean acres are holding steady at 87.5 million, noting the expectation for growth in crush to support larger soy oil demand and biofuels in 2023.

“Domestic meal use is expected higher as those larger supplies figure to be more competitive in feed rations,” Sowell says. “Biofuel use for soybean oil projected up about 8%. Exports for meal expected stronger, particularly in the first part of the marketing year.”

Wildcards for 2023

- Does drought in the Great Plains continue?

- Will we continue to see a strong U.S. dollar?

- What about the weather in South America?

Busy biofuels

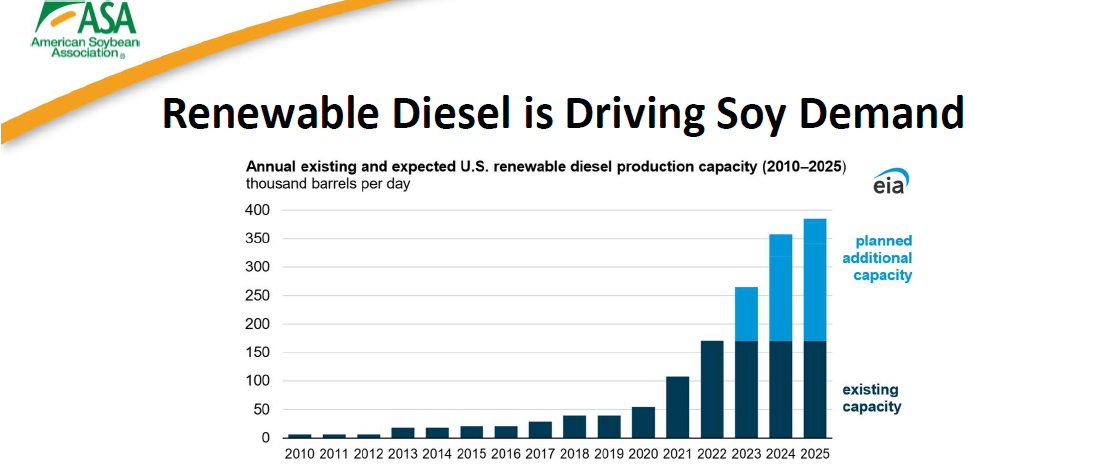

American Soybean Association Chief Economist Scott Gerlt explained the current biofuels picture in the world of soy for 2023. He says in 2021, there was 4 billion gallons of capacity between biodiesel and renewable diesel and 50% more added on top of that a year later. As of 2023, Gerlt says there’s been around 7 billion gallons of renewable diesel capacity announced for the future.

“Those aren’t shovels in the ground,” Gerlt says. “But there is tremendous growth that’s already occurring.”

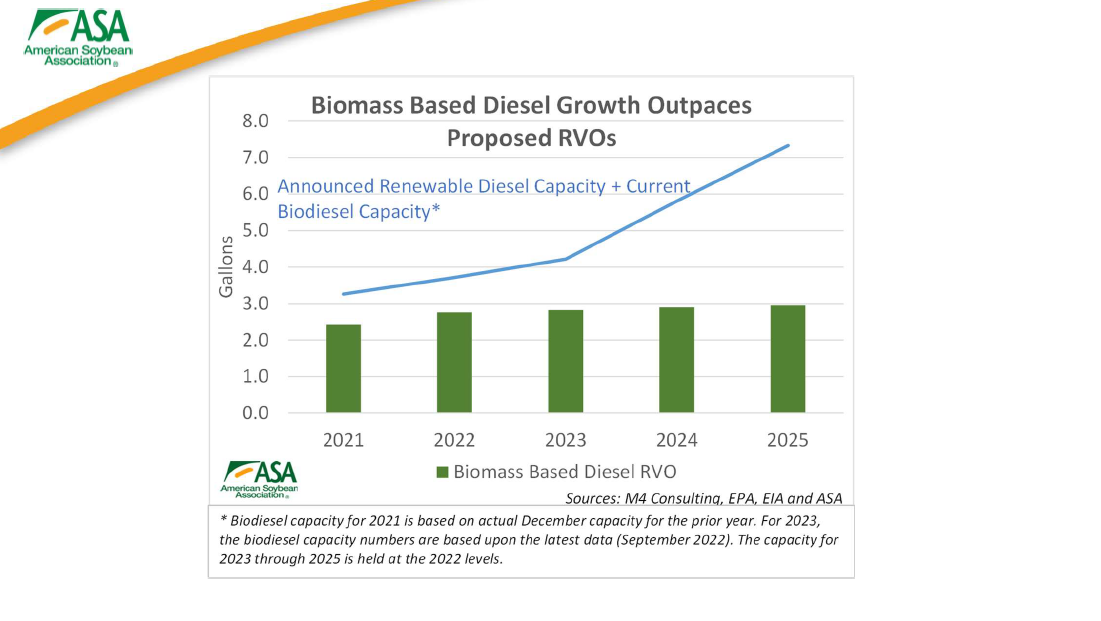

Unfortunately, Gerlt says, there’s currently a “sad part of the story” amidst the growth in the biofuels sector.

“It happened on December 1st last year: EPA for 2022 had raised the biomass diesel volumes under their fuel standards by about 500 million gallons that was the record, they indicated they wanted to go that direction but they released their new proposal on December 1 and it had almost no growth over the next three years. Everyone was happy to have some three-year stability in the industry, but then there's almost no growth.

He continued, “So their proposal is an increase of 200 million gallons over 3 years. And so we're talking about billions of gallons of announced expansion. EPA has proposed the blending levels at 200 million gallons more. So, all of a sudden you really don't need all of those renewable diesel plants because the size of the Renewable Volume Obligations (RVO) largely determines the size of the blending pool.”

Gerlt explained the flaw in the EPA’s determination hinged on using a baseline instead of a forecast, and the decision then impacted the markets. However, Gerlt says the good news is the decision isn't final yet.

“The final rule is due June 14th from EPA. That's when we'll have certainty.”

Wacky weather?

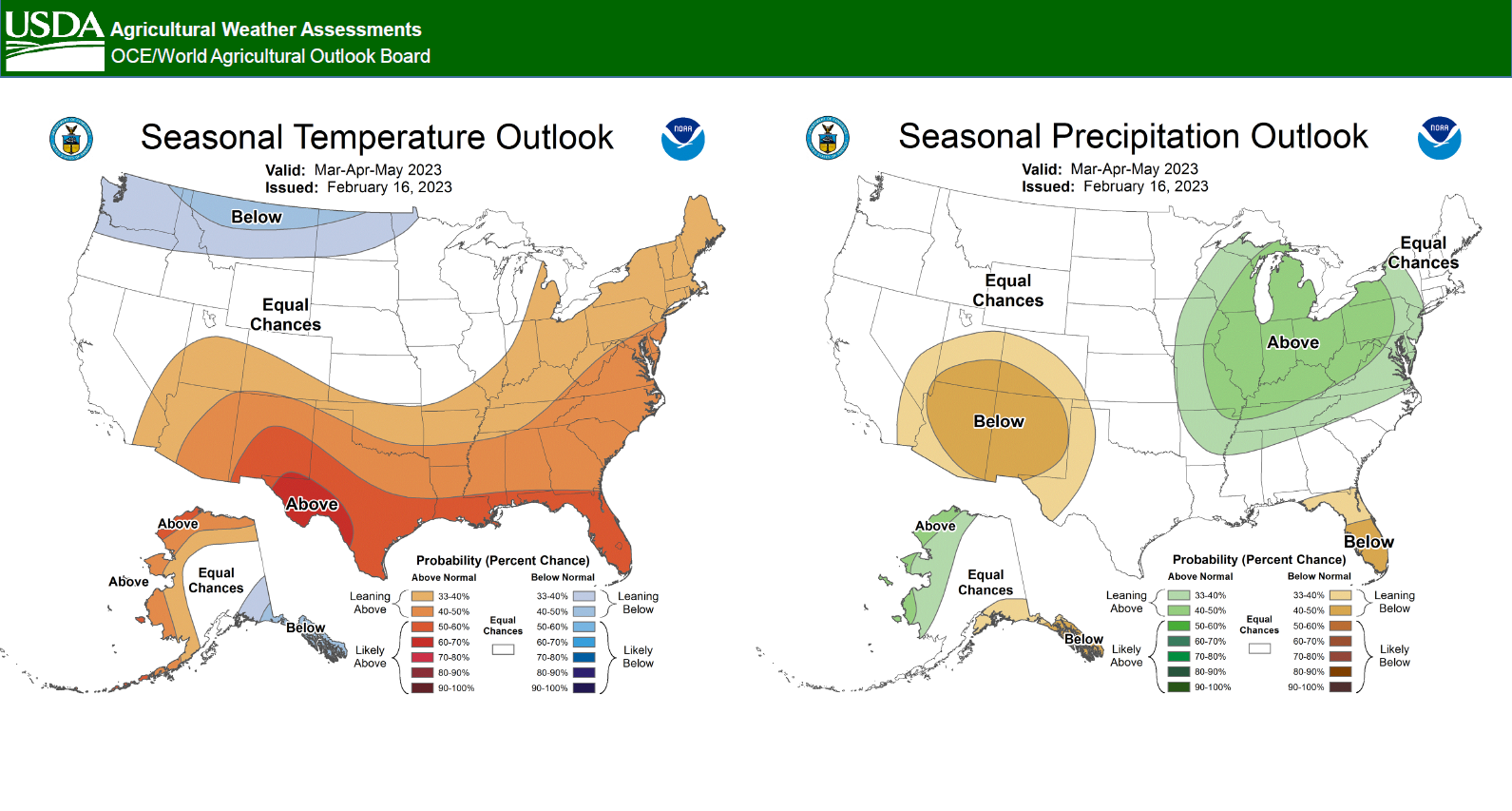

After three consecutive La Nina years, USDA Chief Meteorologist Mark Brusberg says 2023 is expected to see the arrival of the El Nino pattern instead of a return to normal weather patterns. While Iowa farmers typically notice the effects of El Nino during the winter, Brusberg explained an El Nino pattern will likely have ramifications in the southern hemisphere and continue the drought conditions in the southwest United States.

“(In Argentina), the years after La Ninas, they tend to rebound,” Brusberg says. “Some years they have had record yields after several poor yields. If I were a farmer in Argentina, I would be optimistic. Not a forecast, but I would think that I wouldn't see another year of drought.

He continued, “Brazil oilseeds, toss a coin. We have seen good years and bad years. We've had record years during La Nina. We've had record years during El Nino. The key is Rio Grande do Sul and in some years Parana and that's really what we're looking at, it's two different types of climates there. This is the outlook for the United States: they are expecting a continuation of warmth and dryness in the Southwest.”

Back