(Photo: Courtesy of U.S. Soybean Export Council)

Why Indonesia matters for U.S. soy

October 16, 2025

Written by Jim Sutter, CEO of the U.S. Soybean Export Council

Since the early 1980s, the Indonesia-U.S. Soy partnership has grown into one of the most important in Southeast Asia. For U.S. soybean farmers, processors, and exporters, USSEC’s work with Indonesian buyers of U.S. Soy continues to create opportunities in one of the region’s most dynamic and promising markets. It’s projected to become the world’s fourth-largest economy by 2050.

With a population of over 280 million people spread across more than 17,500 islands, Indonesia is the world’s fourth most populous country. Its location along a key global trade route, combined with vast natural resources and fast-growing urban centers, makes it a hub of commerce in the region. Today, more than half of Indonesians live in cities, fueling steady demand for food, consumer goods, and services.

Even though the middle class has recently contracted, mid-to long-term potential is still there. With the right reforms and policies, demand for high-quality foods and strong supply chains will continue to expand. That’s where U.S. Soy is well-positioned to deliver.

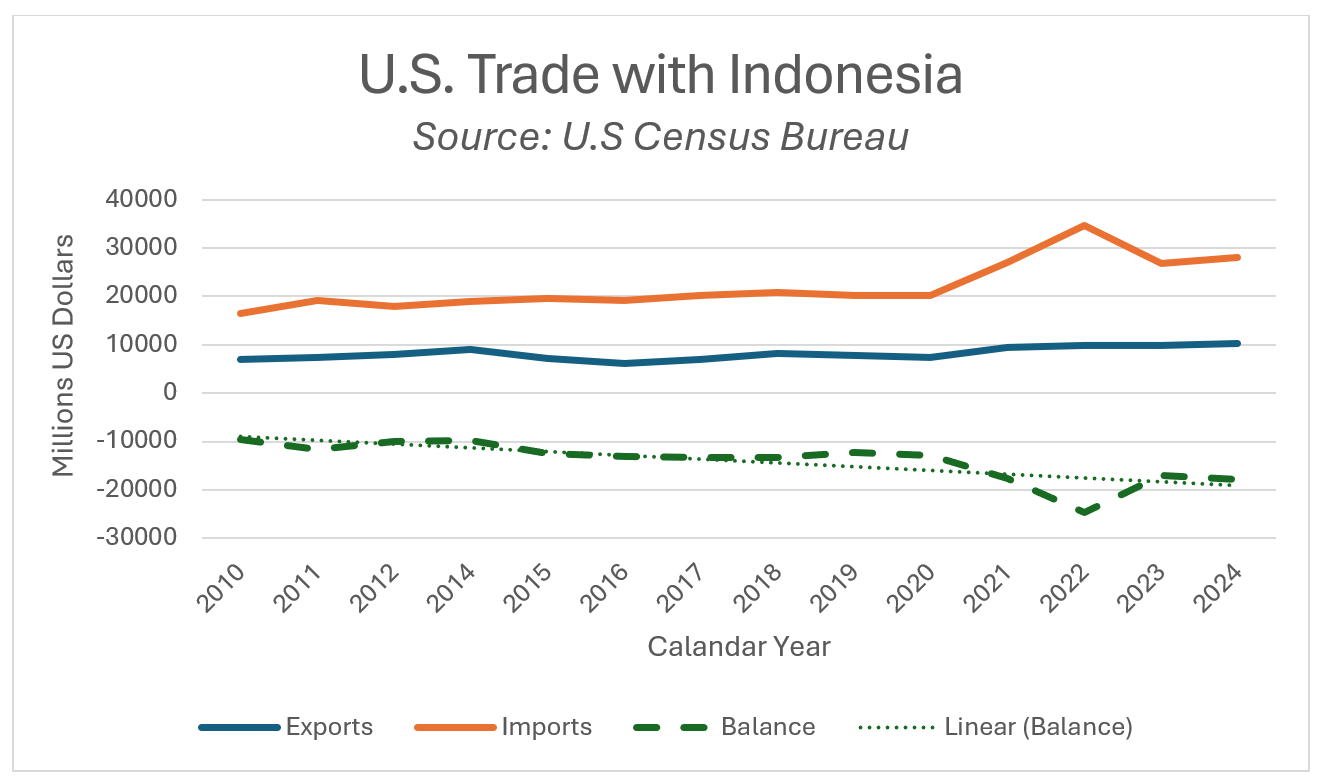

Balancing the Trade Relationship

The U.S. is already one of Indonesia’s largest trading partners. In 2024, trade between the two countries topped $38 billion, but the balance has long leaned in Indonesia’s favor. Last year the U.S. posted a $17.9 billion deficit, with much of it due to palm oil, coffee, cocoa, and other agricultural imports. For U.S. exporters, Indonesia ranked as the 19th-largest market, taking in $10 billion in goods and services, while the U.S. imported $28 billion in return.

This imbalance was at the heart of recent negotiations that resulted in the U.S.-Indonesia Agreement on Reciprocal Trade, signed on July 23, 2025. The agreement was quickly welcomed by U.S. farmers and industry groups like the American Soybean Association, the National Oilseed Processors Association, the National Grain and Feed Association, the U.S. Grains & BioProducts Council, and USSEC.

Here’s what it means in practice:

- Indonesia will remove 99% of tariffs on U.S. food, agriculture, and industrial products.

- The U.S. will cut tariffs to 19% on Indonesian goods, with the option for more reductions.

- U.S. farm exports will be exempt from licensing requirements and quota rules.

- Indonesia will officially recognize U.S. certifications for meat, poultry, dairy, and plant-based foods.

On top of this framework, the two governments announced more than $23 billion in potential commercial deals, including $4.5 billion in U.S. food and agricultural exports such as soybeans, soybean meal, wheat, and cotton.

On August 29, 2025, a federal appeals court decision overturned the Trump administration's "Reciprocal Tariff" policy, which threatened tariffs on trading partners with large trade surpluses. For now, tariffs on almost all goods from nearly every country the U.S. trades with will stay in place until mid-October. After October 14, 2025, they will no longer be enforceable, according to the court ruling. The final decision now rests with the Supreme Court.

Where Agriculture Fits In

Indonesia is the largest economy in Southeast Asia, and in 2024 it ranked as the 11th-largest destination for U.S. agricultural exports. Last year alone, the U.S. exported $3 billion in farm products to Indonesia, led by soybeans, distillers’ grains, dairy, wheat, cotton, and beef.

At the same time, imports from Indonesia have risen quickly, tripling since 2010 to reach $4 billion in 2024. Palm oil accounts for much of that growth, but seafood and wood products also play a role. Taken together, these flows have created a U.S. agricultural trade deficit of $3.7 billion.

The Soy Story in Indonesia

Indonesia has a strong cultural preference for traditional soy-based foods such as tempe and tofu. Its feed and livestock industry, driven by the poultry sector, plays a central role in its agricultural economy. Here’s what this looks like in terms of trade:

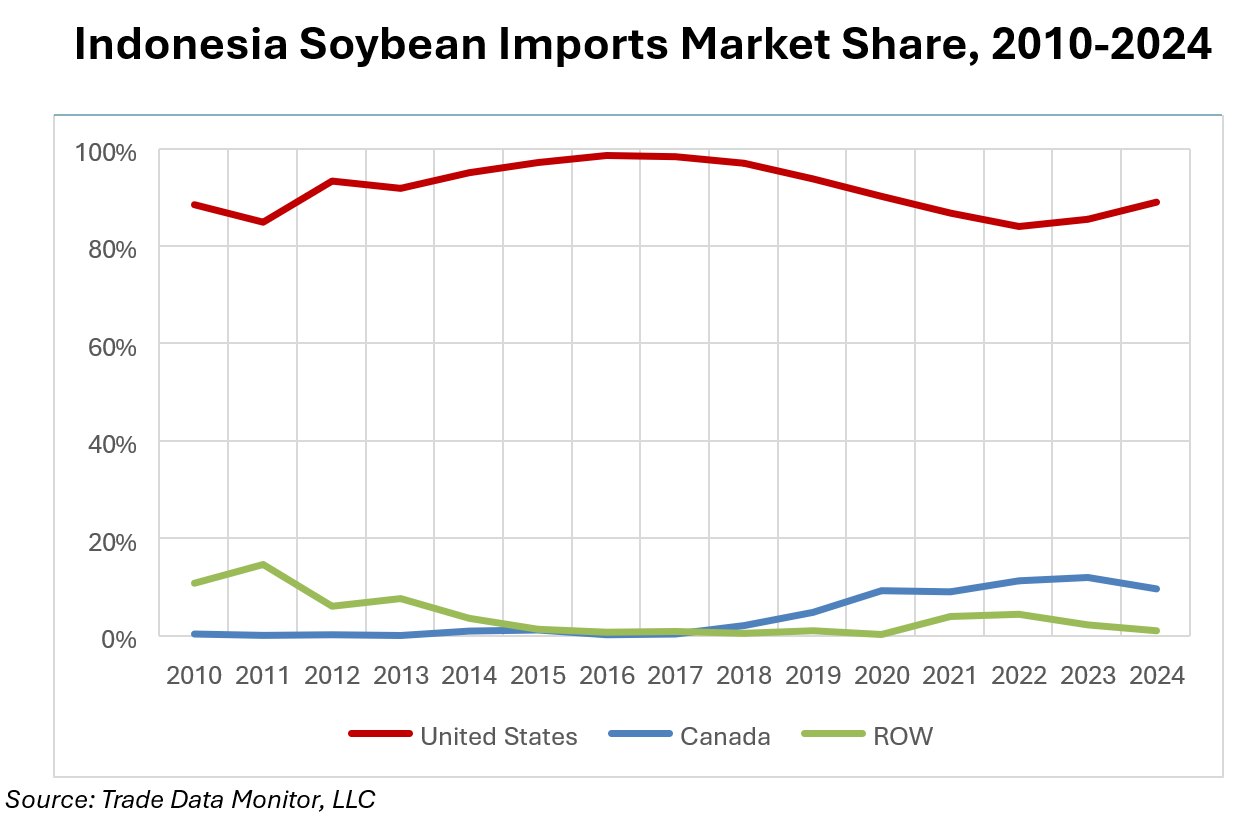

Soybeans

Soy is a staple of the Indonesian diet, particularly in the form of tofu and tempeh. That makes Indonesia the largest market for U.S. soybeans in Southeast Asia and the third largest worldwide. Exports grew 67% from 2010 to 2024, and thanks to zero percent MFN (most-favored nation) tariffs and consumer preference, the U.S. now holds an impressive 89% market share. The new trade deal should help keep that momentum going.

Soybean Meal

The story is different here. Indonesia depends on imports to supply its 100 feed millers, most of which focus on poultry. Yet U.S. soybean meal exports have declined from $180 million in 2010 to $75 million in 2024, as Brazil and Argentina captured more market share with lower prices. Still, with the new agreement and Indonesia’s pledge to buy more U.S. agricultural products, there is room for U.S. Soy to reclaim ground.

Looking Ahead Together

The future of U.S.-Indonesia agricultural trade is promising, but much will hinge on how the new agreement is implemented. The pledge to buy an additional $4.5 billion in U.S. farm products is a big step forward, but global competition remains fierce.

That’s why USSEC’s role is so important. By working closely with buyers, feed millers, and food producers in Indonesia, USSEC continues to showcase the unmatched strengths of U.S. Soy: sustainability, quality, reliability, nutrition, and strong in-market support.

As Indonesia’s economy continues to evolve, the partnership with U.S. Soy is well-positioned to provide the food security, economic support, and high-quality protein that this vital market needs.

Back