(Photo: StoneX)

Q&A: Trade, tariffs and trends shaping soybean prices

November 20, 2025 | Kriss Nelson

Over the past month, soybean markets have improved on renewed optimism about U.S. and China trade, flash export sales and the latest U.S. Department of Agriculture’s (USDA) World Agriculture Supply and Demand Estimates (WASDE) update.

To help make sense of the movement, and what it means for farmers heading into 2025, we spoke with Jake Moline, risk management consultant at StoneX for a breakdown of key trends, policy updates and marketing considerations.

What has happened over the last month with the soybean market?

The soybean market has been on a nice run since mid-October, mainly fueled by optimism around the trade relationship between the U.S. and China improving.

Nearby soybean futures have rallied around $1.50 since mid-October fairly consistently, but have recently shown some signs of indecision.

The meeting between President Donald Trump and Chinese President Xi Jinping in South Korea heightened market attention on the U.S.-China trade relationship, which had essentially stalled into an embargo because of the tit-for-tat tariffs in place.

After the meeting took place, U.S. Secretary of the Treasury Scott Bessent announced that China had agreed to purchase around 440 million bushels of U.S. soybeans prior to the end of 2025 (keep in mind purchasing and taking shipment are different things). He also stated that China had agreed to purchase around 880 million bushels annually between 2026 and 2028. While those figures don’t exceed normal soybean export business with China, they represent a potential shift back toward a normal trade relationship.

Until recently, the issue has been China’s lack of acknowledgment of the agreement. To put it in relationship terms, after the post-Trump/Xi meeting, it seemed as though the U.S. had the impression they were “going steady” with China, while China viewed it as more of an “open relationship” and had been “ghosting” the U.S.

On Friday, Nov. 14, the USDA released its first WASDE update in over a month, along with a dump of flash sales announcements that would have occurred during the government shutdown.

The initial total of soybean flash sales released last Friday amounted to about 50 million bushels but was revised lower on Monday. That same day, rumors circulated that China had purchased U.S. soybeans. Those rumors were corroborated through the daily flash sales announcement on the following day and that pattern continued in the coming days.

Thus far, China has committed to buying about 46 million bushels of U.S. soybeans, which is about 10% of what they “committed” to buying from the U.S. before the end of 2025.

Theories have circulated that China could have been behind much of the recent strength in soybean futures, attempting to front-run physical purchase announcements that would trigger speculative buying from market participants and provide ample liquidity for China to exit futures length as they book flat-price physical bean purchases.

To spice up the theory, China’s buying would have been concealed from the market as regular commitment of traders reports released by the Commodity Futures Trading Commission (CFTC) have been absent during the government shutdown and the plan to “catch up” those reports means we won’t know the true position of major market participants until late January.

While China reaching the U.S. interpreted commitment of 440 million bushels before year’s end is not impossible, the more difficult question to answer is how much of that total is baked into market and the current USDA balance sheet?

No major surprises came from the USDA’s November WASDE for soybeans. As expected, the USDA cut the soybean yield by 0.5 bushels per acre to 53 bushels per acre, essentially matching pre-report expectations.

That 48 million bushel drop in production was partially offset by a 14 million bushel drop in the carry-in figure derived from the Sept. 1 stocks report.

The only change made by the USDA to the 25/26 demand was a 50 million bushel drop in exports. One could make the case that the cut was not near enough, given our horrendous inspection pace, but with the “trade deal” with China currently in limbo, one can understand the more reserved approach to cutting.

In the end, the 25/26 soybean carryout fell 10 million bushels to 290 million bushels and carryout/use dropped from 6.89% to 6.74%.

While the feed demand number is the elephant in the corn balance sheet’s room, export demand is that to soybeans. The door may be slightly cracked open for the USDA to make uncharacteristic yield adjustments in their December WASDE, something typically reserved for final production figures that accompany the January report, but I’d put the chances of that happening below 5%. If they decided to make those adjustments in December, the USDA would let the market know before the report’s release.

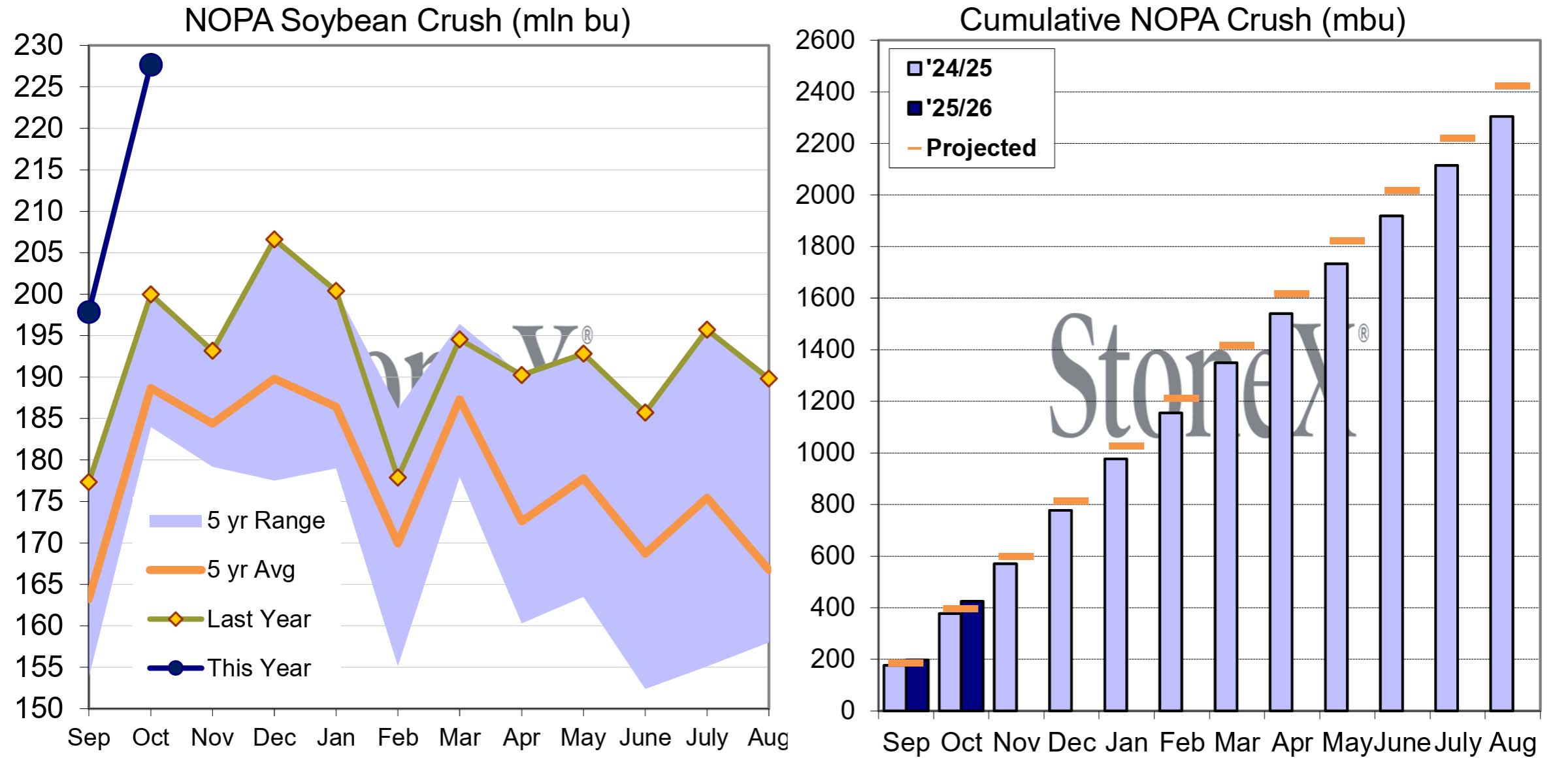

Overall, material changes to the domestic soybean balance are far more likely to come from the demand side, with crush demand likely to receive a boost after the record October crush figure reported by the National Oilseed Processors Association (NOPA) on Monday.

September–October crush is now 13% ahead of last year’s pace, while the USDA projects only a 5% year-over-year increase.

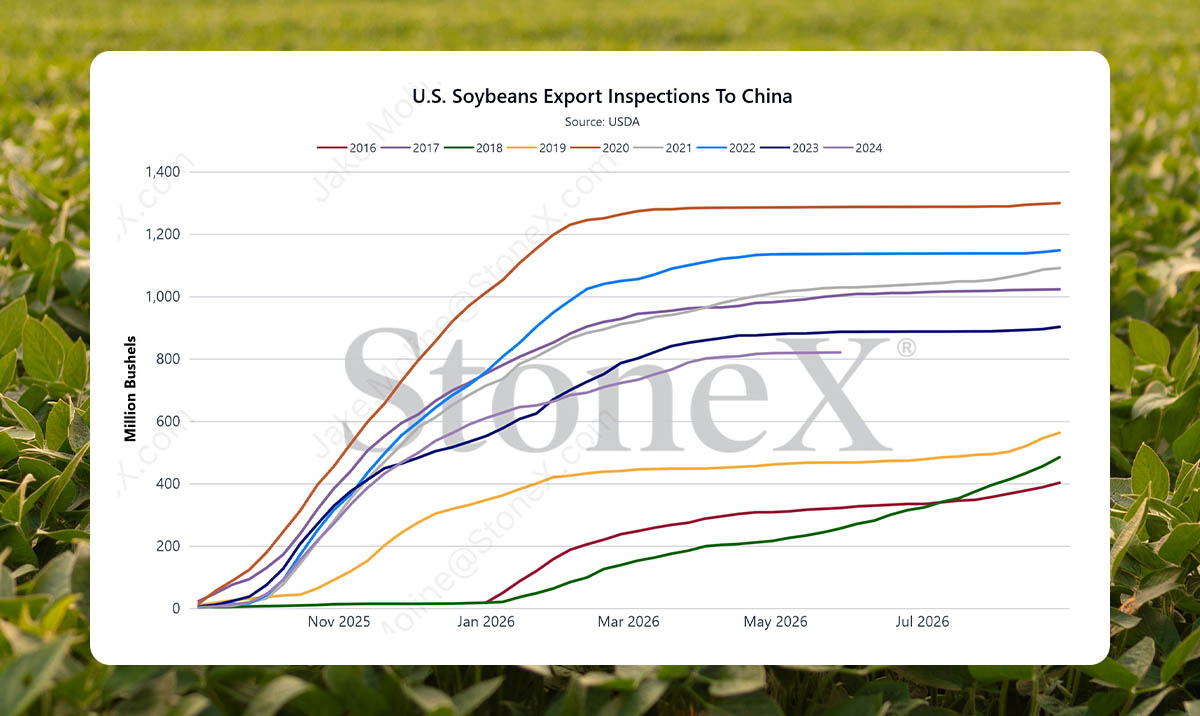

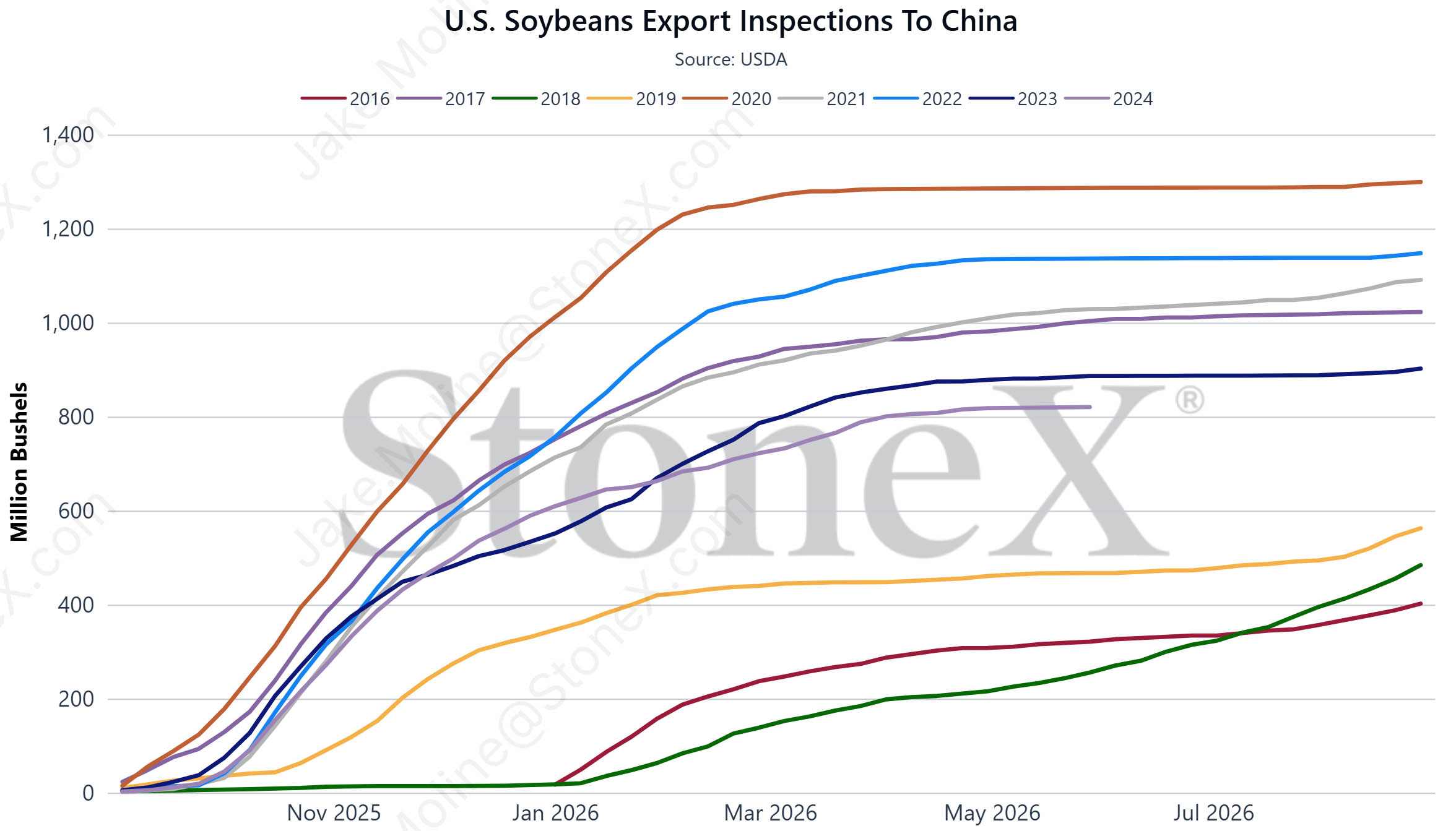

Major revisions to export demand are still very possible because soybean export inspections are currently running about 175 million bushels (11%) behind the pace needed to meet the USDA’s current annual export estimate.

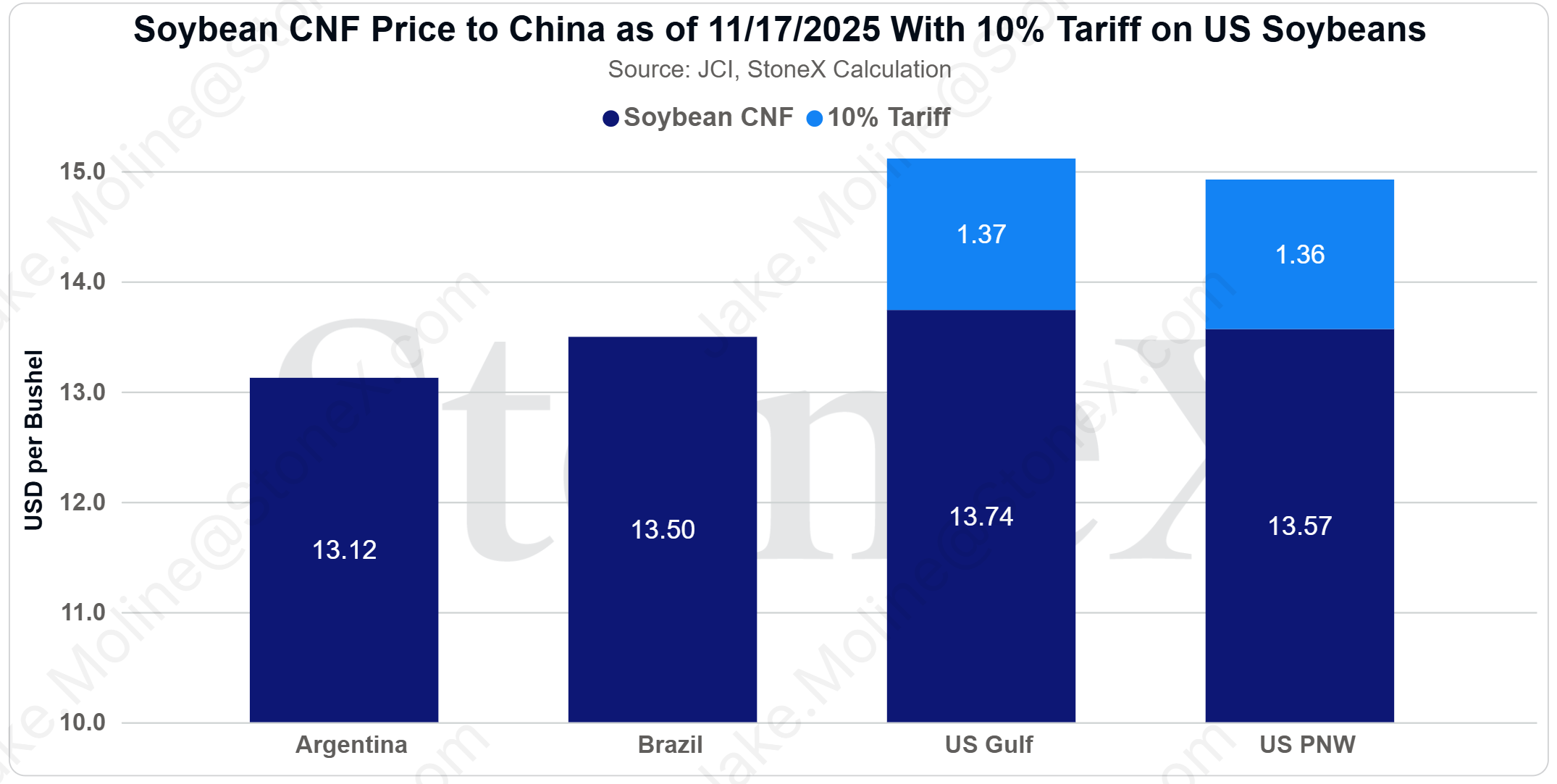

Recent purchases made by China seem driven by political motives rather than fundamental or economic factors.

Brazilian soybeans delivered into China currently have about $1.50/bushel advantage vs. U.S. soybeans, thanks mainly to the 10% tariff difference between the two sources.

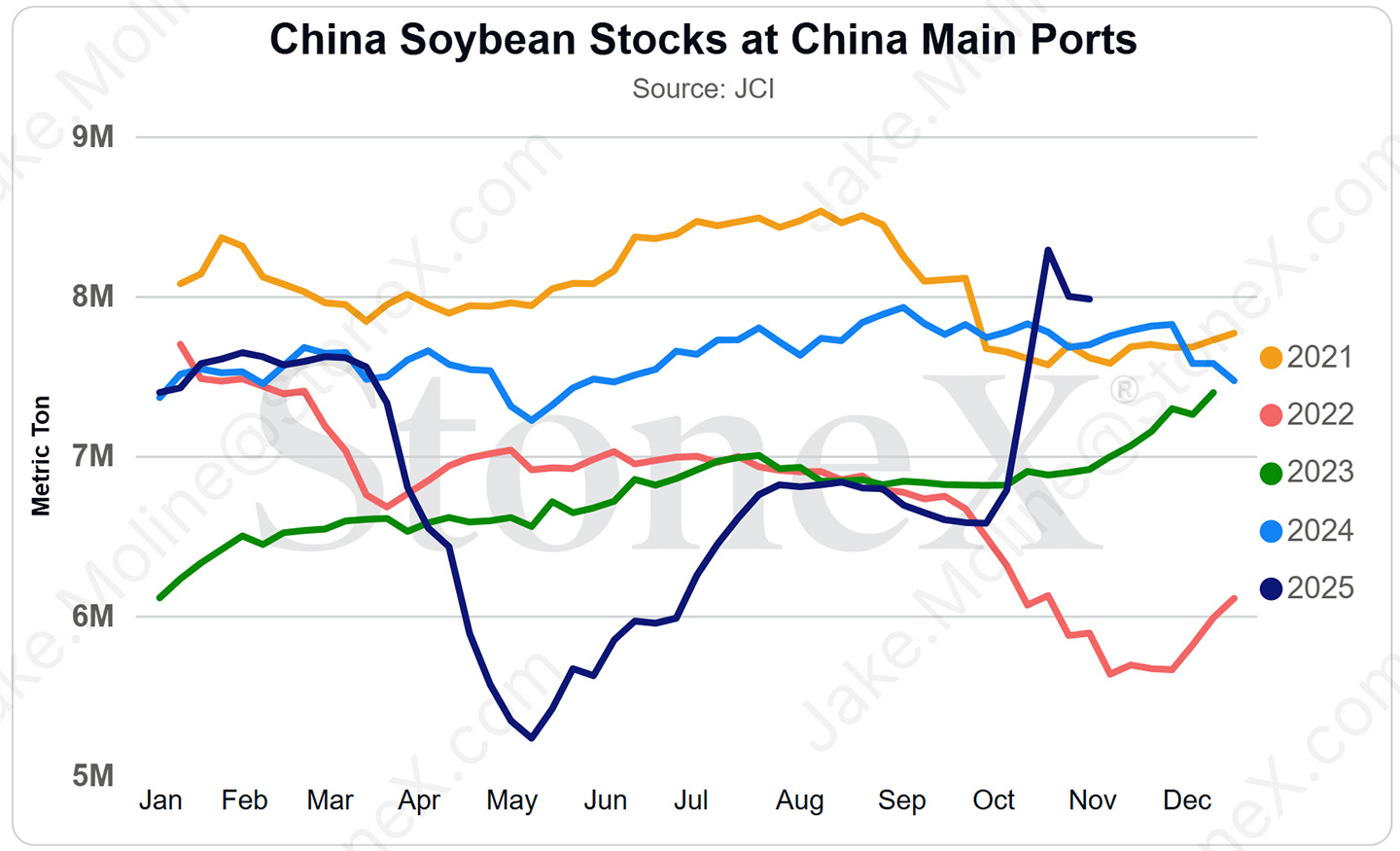

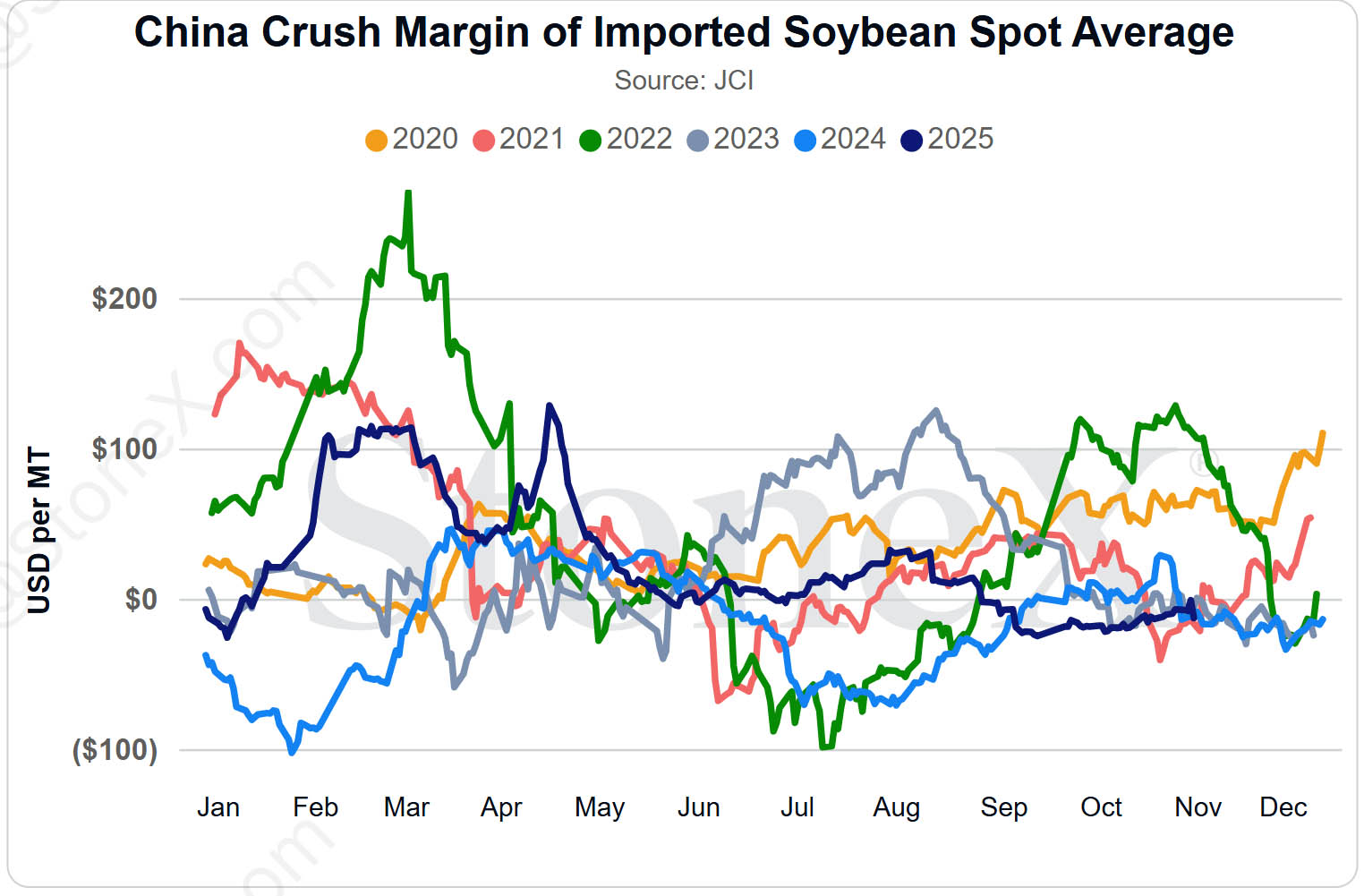

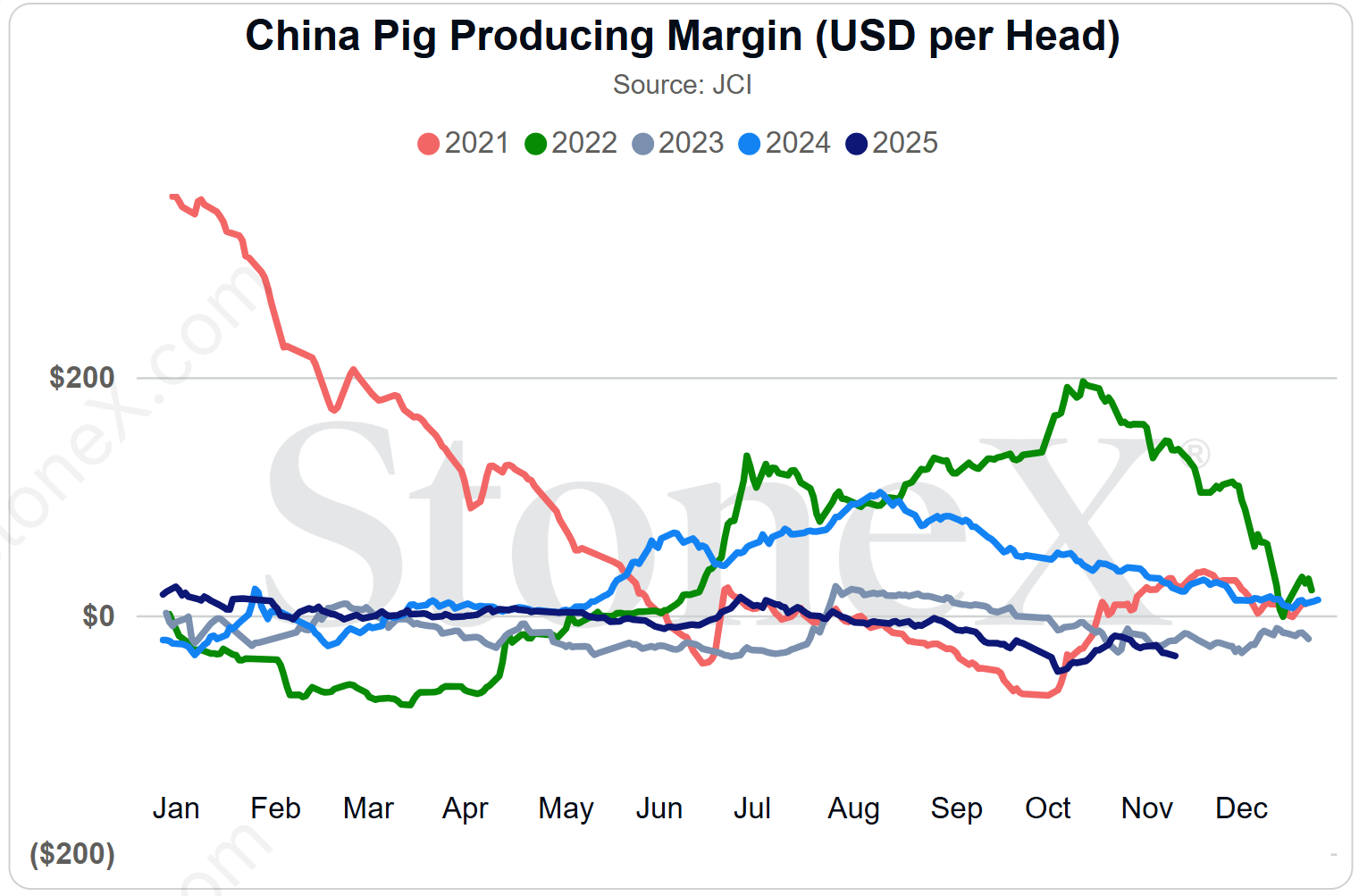

China could waive that tariff, but soybean stocks at major ports in China are near seasonal highs, and with Chinese soybean and hog crush margins in negative territory, questions remain about the overall demand outlook for China moving forward.

How would you summarize the farm bill update for farmers?

For soybean growers, the most significant changes under the One Big Beautiful Bill Act this summer occurred in Title 1 crop programs.

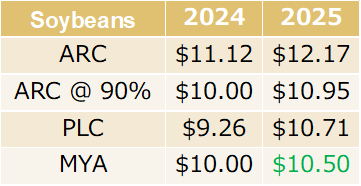

Through the bill, major increases in Price Loss Coverage (PLC) reference prices occurred. The reference price for soybeans increased from $9.26 up to $10.71. The program increased the payment trigger for Agriculture Risk Coverage (ARC) from 86% to 90% of expected revenue and the max payment from 10% to 12%.

The current price used in ARC is $12.17 (the Olympic average of the past five years of Market Year Average (MYA) prices from the USDA).

For 2025 only, the grower will get the better of the two payments from either ARC or PLC, regardless of what they elected in the spring of 2025. Payments in both ARC and PLC are tied to the USDA’s MYA price. The MYA price is a weighted-average estimate of the cash price farmers receive for their crops. Because a much higher percentage of the soybean crop is sold in the fall through winter timeframe, prices during these months have a higher impact on the USDA’s MYA price.

The 2018 Farm Bill was extended through Sept. 30, 2026, preventing outdated “permanent law” provisions from taking effect. This extension ensures the continued operation of programs like the Conservation Reserve Program (CRP), which otherwise would have halted new enrollments.

Heading into the end of 2025, what are the key marketing considerations for farmers?

Because ARC and PLC prices now sit at high levels relative to the USDA’s current MYA price, which was raised from $10.00 up to $10.50 in the November WASDE report, both programs are currently projecting payments for soybean growers, or are what a trader would label, “in-the-money”.

The USDA’s increase in the MYA in the November WASDE made them less in the money, but savvy growers/advisors who were aware of their projected payments could have hedged those before the runup in prices and increased MYA price by buying calls or call spreads. This would have been especially important for bushels that were sold across the scale at lower prices this fall.

As for the subject of direct payments, we have heard nothing out of the Trump administration since the government shutdown ended, but concerns that the recent runup in soybean futures prices may limit or eliminate direct payments floated by the administration prior to the shutdown are warranted.

Moving forward, growers will be able to purchase SCO (Supplemental Coverage Option) with either ARC or PLC where, in the past, electing ARC disqualified growers from purchasing the SCO endorsement.

Recent increases to subsidy rates for supplemental insurance products like SCO and Enhanced Coverage Options (ECO), along with raised reference prices for PLC and increased payment triggers for ARC, are making it cheaper for growers to purchase higher levels of coverage through crop insurance.

Does this mean growers can abandon good grain marketing habits? No. It means growers need to take the time to understand how these programs work and how they can be combined with quality marketing plans. Because crop insurance and grain marketing can seem overwhelming and complicated to many, seeking out a quality advisor is key.

Compiled by Kriss Nelson.

Back