USDA Chief Economist Dr. Seth Meyer (Photo: File Photo)

Predictions for ’24: 100th USDA Ag Outlook Forum

February 22, 2024

After two years of historical highs, new challenges may be awaiting America’s farmers in 2024. USDA Chief Economist Dr. Seth Meyer helped open the USDA’s 100th annual Ag Outlook Forum where he outlined his expectations for the upcoming growing season.

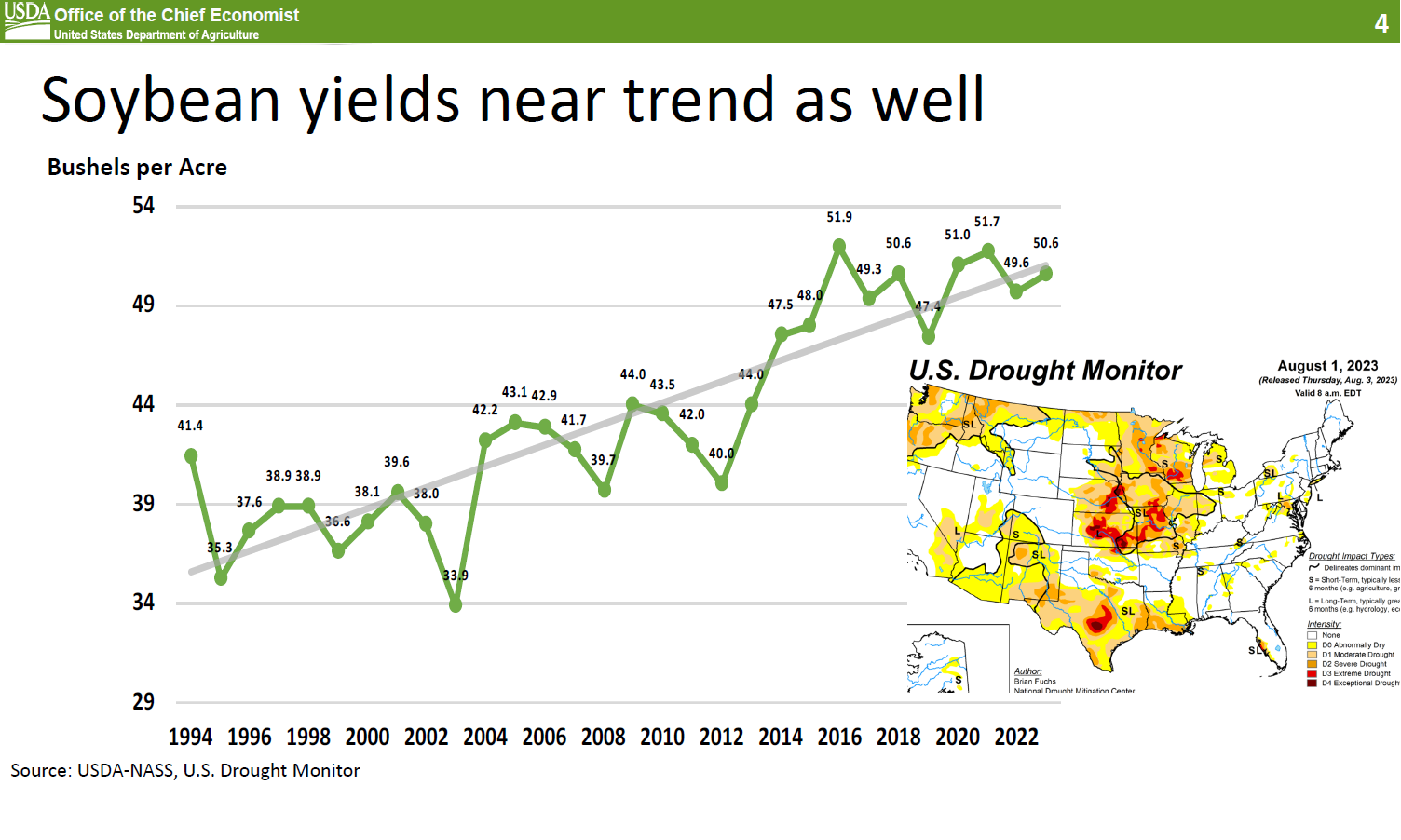

Before moving to his expectations for ’24, Meyer summarized the ’23 growing season as having two surprises: resiliency in production and flexibility in the field despite a challenging year weather-wise.

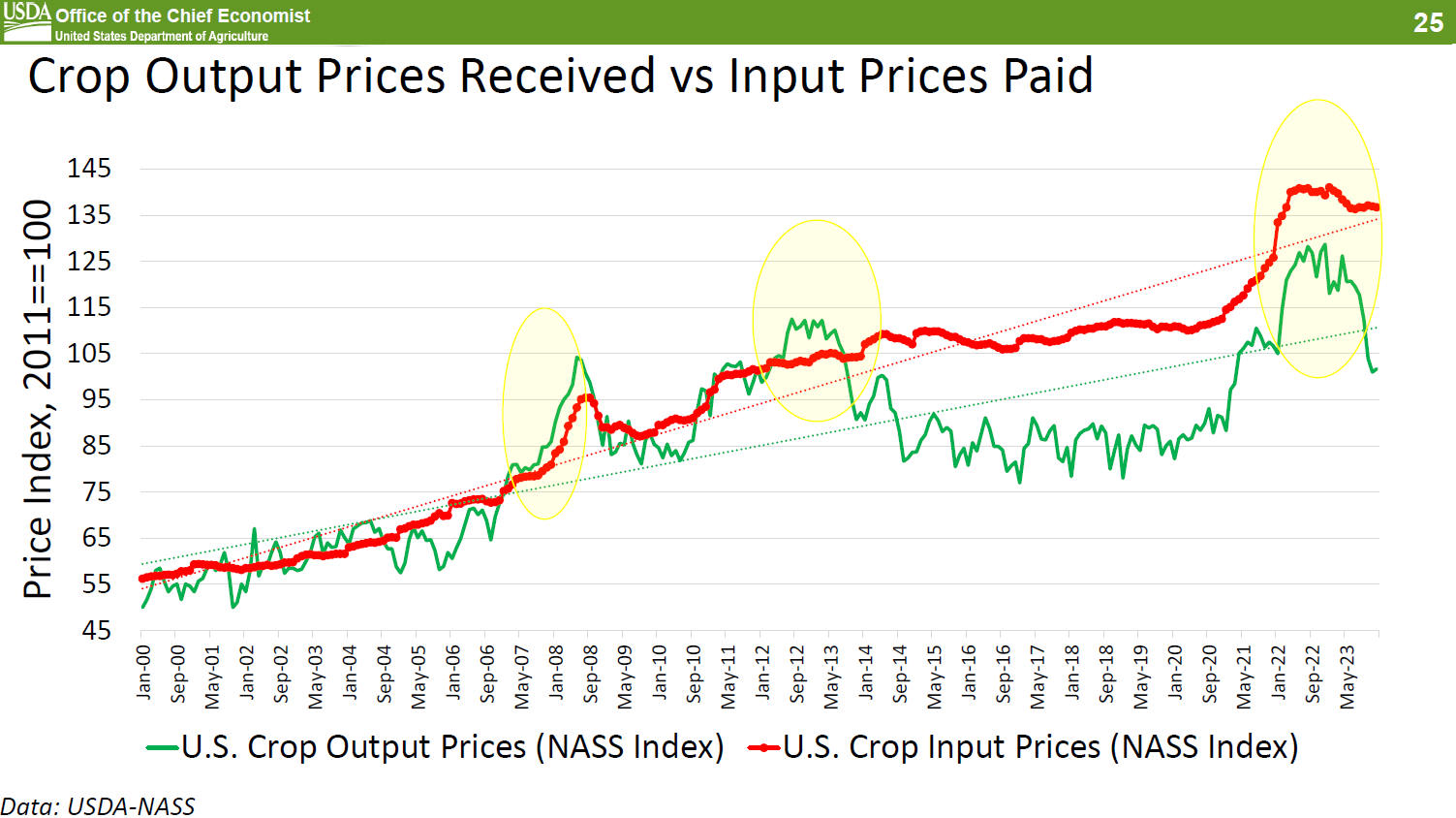

Challenge: “Sticky” input prices

Fertilizer prices are down from their peak. But other inputs have been more stubborn.

“Fertilizer is a global commodity, it tends to generally follow commodity prices, but it is only one part of a crop budget,” says Meyer. “For many of the other lines in a crop budget, they tend to move and be sticky when commodity prices fall. We have had three global price spikes in food over the last 15 years and in each of these, in the first two when the prices spiked for output, input prices follow them, when commodity prices normalize those input prices tend to be sticky, which shrinks producer margins.”

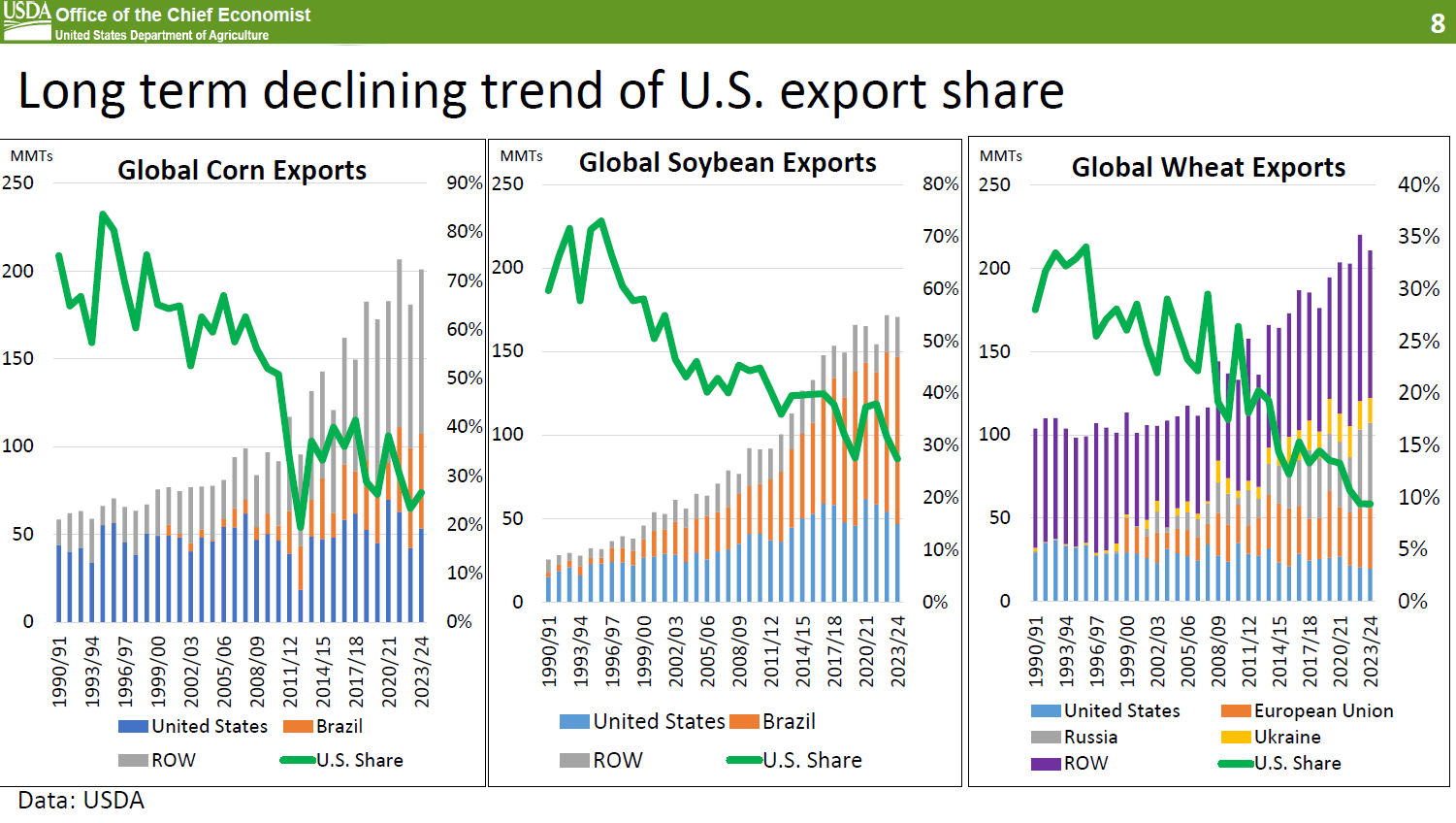

Challenge: Exports

“I think one of the good things is, we’ve seen a lot of growth in trade for agriculture commodities,” Meyer says. “Maybe the challenge is other countries have also stepped up and are producing more. Our challenge is our export share has declined; we’ve got more competition in the global market but we need that trade to continue to grow.”

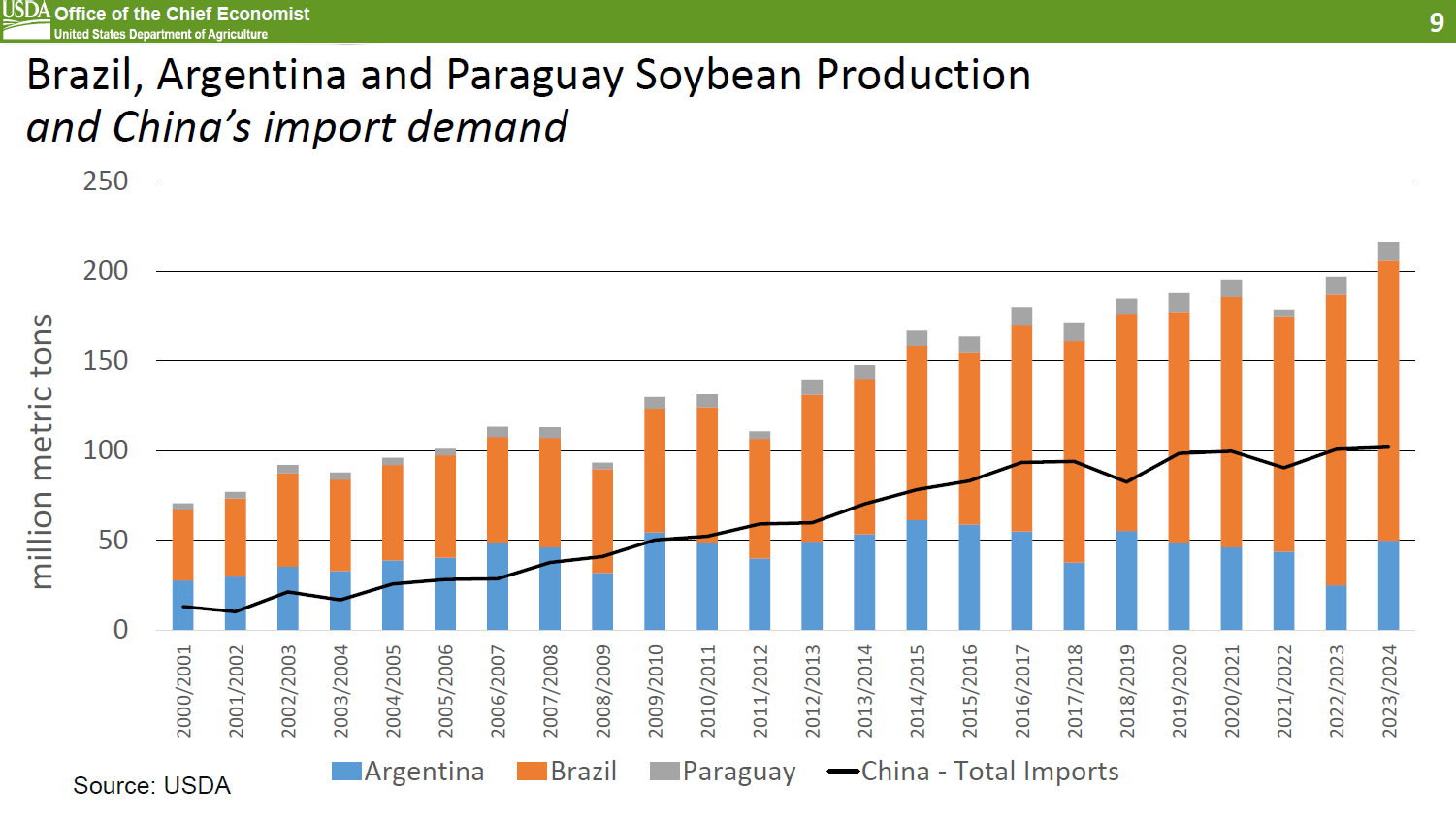

Focusing in on soybeans, Meyer said challenges aren’t just in supply but in demand as well.

“When you think about Brazil, Paraguay, Argentina, tremendous growth in production,” says Meyer. “And we can handle that production at a global level and support prices when Chinese demand was growing more than 4% up to 8% a year.

He continues, “So, we had China in the market pulling large volumes of soybeans off the market. That demand has slowed. Who’s going to pick up that demand as we get an additional 6 million metric tons from Argentina? Land is expanding, they’re going to continue to grow. We have a challenge here as how are we going to meet export demand and what are we going to do internally for demand?”

Fortunately, Meyer says domestic demand for soybeans remains strong, due mostly to biofuel demand.

“This is a very policy driven market, but if we want to have a domestic use for our crops this is one of the options that is at least in front of us,” says Meyer.

Back