Is this a sell signal?

February 12, 2026 | Kriss Nelson

After the U.S. Department of Agriculture (USDA) left the domestic soybean balance sheet unchanged in their February World Agricultural Supply and Demand Estimates (WASDE) report, questions quickly shifted from what the report said to what the market does next.

“The only adjustment to the domestic corn or soybean balance sheets was a 100 million bushel increase in corn exports, which is well supported by the current pace of export sales and shipments,” says Jake Moline, risk management consultant with StoneX.

Domestic equilibrium price discussion

Moline said soybean and corn prices are trading near what he considers domestic equilibrium levels, with March 2026 corn around $4.20 per bushel and March 2026 soybeans near $11.20 per bushel, even as uncertainty around exports, China’s buying pace and global supplies continues to drive volatility.

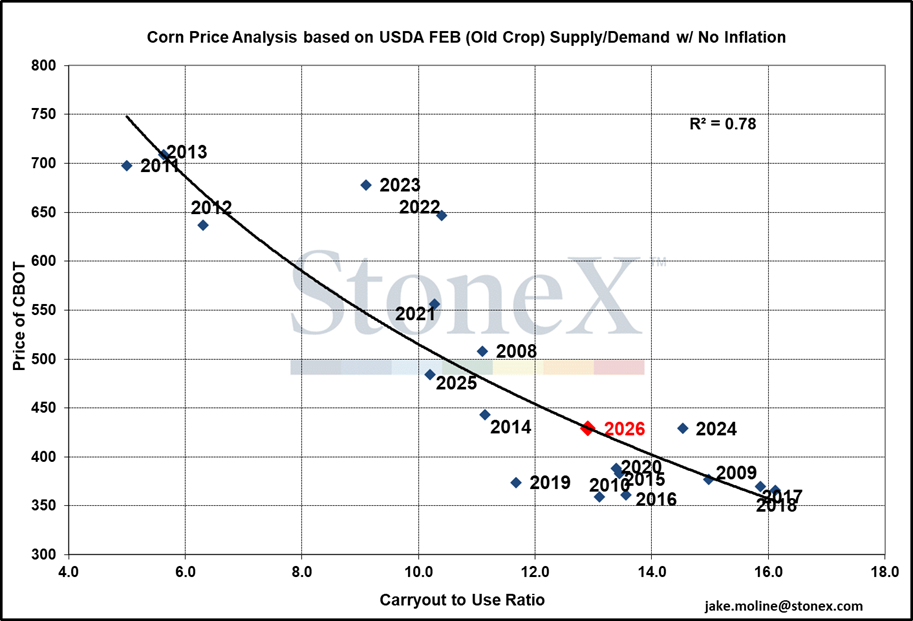

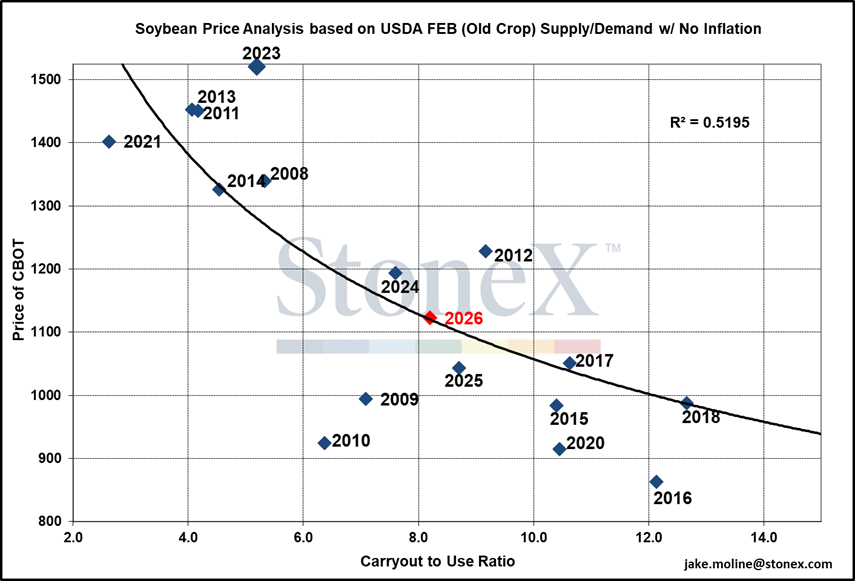

When historical carryout-to-use ratios are charted against March 2026 futures prices using data from the February WASDE, a clear relationship between supply and price emerges. Both corn and soybeans are currently trading near that long-term trend line, suggesting the market is close to what some analysts would consider a domestic equilibrium.

“When you chart carryout-to-use ratios against March 2026 futures closes on the day of the February WASDE, Tuesday’s closes sit right on that trend line,” says Moline. “After the January WASDE, soybeans were about 50 cents below that line, likely because of expectations for record South American production and the trade policy tensions we’ve been dealing with.”

A price rally last week, sparked by President Trump’s social media comments, has since narrowed that gap, he added while cautioning questions remain about how durable that support will be and whether China will follow through on the rumored purchases and ultimately take delivery of the roughly 550 million bushels the market is watching.

March 2026 corn futures align closely with the long-term relationship between price and carryout-to-use ratios based on the February WASDE, suggesting prices are near domestic equilibrium.

March 2026 soybean futures have moved back toward the historical trend line after trading about 50 cents below it following the January WASDE, though questions remain about Chinese demand and shipment follow-through.

Global 2025/26 soybean outlook

Forecasts for global soybean supply and use show higher production, increased crush and larger ending stocks. Brazil’s production estimate is raised by 2 million tons to 180 million tons, driven by expanded acreage and strong yields supported by favorable weather and state-level reporting.

Paraguay’s production is also increased by 500,000 tons to 11.5 million tons due to consistent, beneficial rainfall throughout the season.

“Some anecdotal reports of quality issues in Brazil’s largest soybean production state of Mato Grosso have started to surface,” says Moline. “Weeks of heavy rain have inflicted damage on the soybean crop and quality issues, along with forecasted rains that could impose more damage, are prompting farmers to harvest high moisture soybeans and sell at large price discounts as soybeans cannot be stored on-farm in their condition.”

Despite those reports, analysts have not yet lowered Brazilian production estimates.

Global soybean import demand

China is reportedly considering additional purchases of U.S. soybeans, but that does not necessarily mean total global demand is growing. Because global soybean import demand remains largely unchanged from last month, any increase in Chinese buying would likely come from a reshuffling of trade flows rather than a true expansion of the market, shifting more U.S. shipments to China and fewer to other destinations.

“Trade isn’t a zero-sum game, but in this case, more business with China probably means we’re redirecting shipments rather than adding a lot of new demand,” Moline says. “That should temper expectations that any additional Chinese purchases automatically translate into a big increase in overall U.S. exports.”

Export inspections

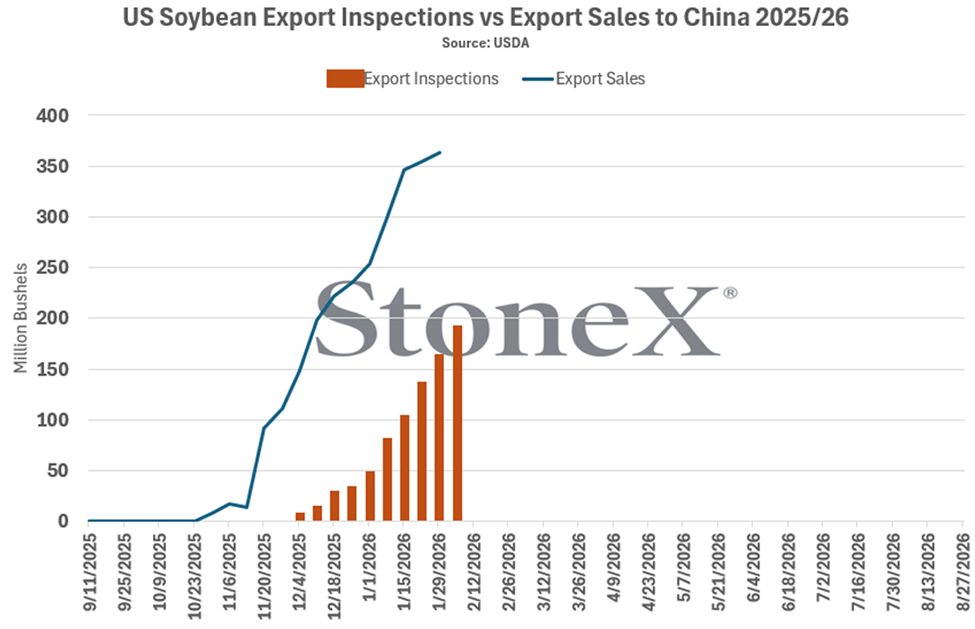

According to Moline, soybean inspections are currently running 265 million bushels behind the pace needed.

“Exporters clearly prioritized corn movement early in the marketing year, a window that typically favors soybeans due to the seasonal pattern of global supply, especially shipments to China,” he says.

To date, the U.S. has shipped 189 million bushels of soybeans to China. If China proceeds with the rumored additional 300 million bushels of purchases by the end of February, the U.S. will need to ship approximately 545 million bushels to China over the remainder of the crop year.

On Monday, Moline noted a flash sale announcement for 264,000 metric tons of U.S. soybeans destined for China for this crop year. China also purchased an armada of soybean cargoes from Brazil around the same time.

Sales commitments to China have climbed well ahead of actual shipments so far in 2025/26, highlighting the gap between booked business and soybeans that still need to move, a key factor as the market watches whether additional purchases turn into deliveries.

Fund pump and dump part deux?

Moline says the last time we had a deal/commitment-announcement, soybeans rallied a dollar in reaction, driven mostly by fund buying.

The first announcement came Oct. 30, 2025, and nearby soybean futures rallied about $1 from that day to a mid-November high, Moline explained. During that period, funds added roughly 100,000 contracts in net length. Over the next two months, funds were net sellers of about 200,000 contracts, and prices fell by more than $1.

“I’m worried we may repeat a similar pattern,” says Moline. “We will have to wait until next Friday’s commitment of traders report to confirm, but the funds were estimated net buyers of 90,000 contracts in the two days following the president’s social media post and prices rallied almost 60 cents during that timeframe.”

According to a report from the South China Morning Post shared by Moline, the United States and China are preparing to extend their current trade truce by up to a year, and the extension may include rolling back certain tariffs for up to one year.

Negotiators aim to finalize the plan at an early April 2026 summit in Beijing, where Presidents Donald Trump and Xi Jinping are expected to meet. As part of the lead-up to the summit, China has resumed purchases of U.S. soybeans, and additional agricultural commitments are reportedly under consideration.

Two key questions

Moline says he looks at the current soybean situation in two parts:

- Part 1: Will China purchase an additional 8 million metric tons, which is nearly 300 million bushels, over the next 18 days?

“I was initially doubtful they would complete the first 12 million metric tons agreed to at the end of October, but they ultimately made those purchases. Daily flash sales at 8:00 a.m. will be important indicators, along with the weekly export sales reports, as we track their progress toward this next target. Near record stocks of soybeans at Chinese ports along with soybean crush and hog crush margins that are teetering near breakeven also increase uncertainty.”

- Part 2: Will China take shipment of all these beans within the current crop year?

“So far, they have taken shipment of about 189 million bushels. If they were to purchase the full 735 million bushels, which equates to 20 million metric tons by the end of February, they would still need to take delivery of approximately 546 million bushels before the end of the crop year,” Moline notes. “I have significant doubts this will occur given the timing, the price differences between U.S. and Brazilian supplies, and the internal demand issues China continues to face.”

Signal to sell?

He views the recent increase in soybean prices as a favorable selling opportunity for U.S. soybean producers.

Growers can also take advantage of the accompanying uptick in implied volatility that make strategies that sell option premium more attractive, he says.

“Moreso than any year in my career thus far, finding ways to collect premium and pad profitability in situations where prices don’t move, will be important in grower marketing plans.”

Because of the major changes made to crop insurance and Title 1 programs through the One Big Beautiful Bill Act (OBBBA), payments from crop insurance and commodity safety net programs are far more likely and will likely make up a higher percentage of overall revenue for growers in the years to come, Moline says.

“Learning how to leverage that reality and make adjustments to your grain marketing plans will be very important.”

Written by Kriss Nelson

Back