The USDA's 100th Ag Outlook Forum's farm income session (Photo credit: USDA)

3 key points: 100th Ag Outlook farm income session

February 29, 2024

One of the longest running and most popular sessions of the USDA’s Ag Outlook Forum over its 100-year history is the farm income session. At the 100th annual Ag Outlook Forum, the farm income session pointed to forecasts for 2024 showing some downward trends, but also some silver linings. Here are three key points from the event:

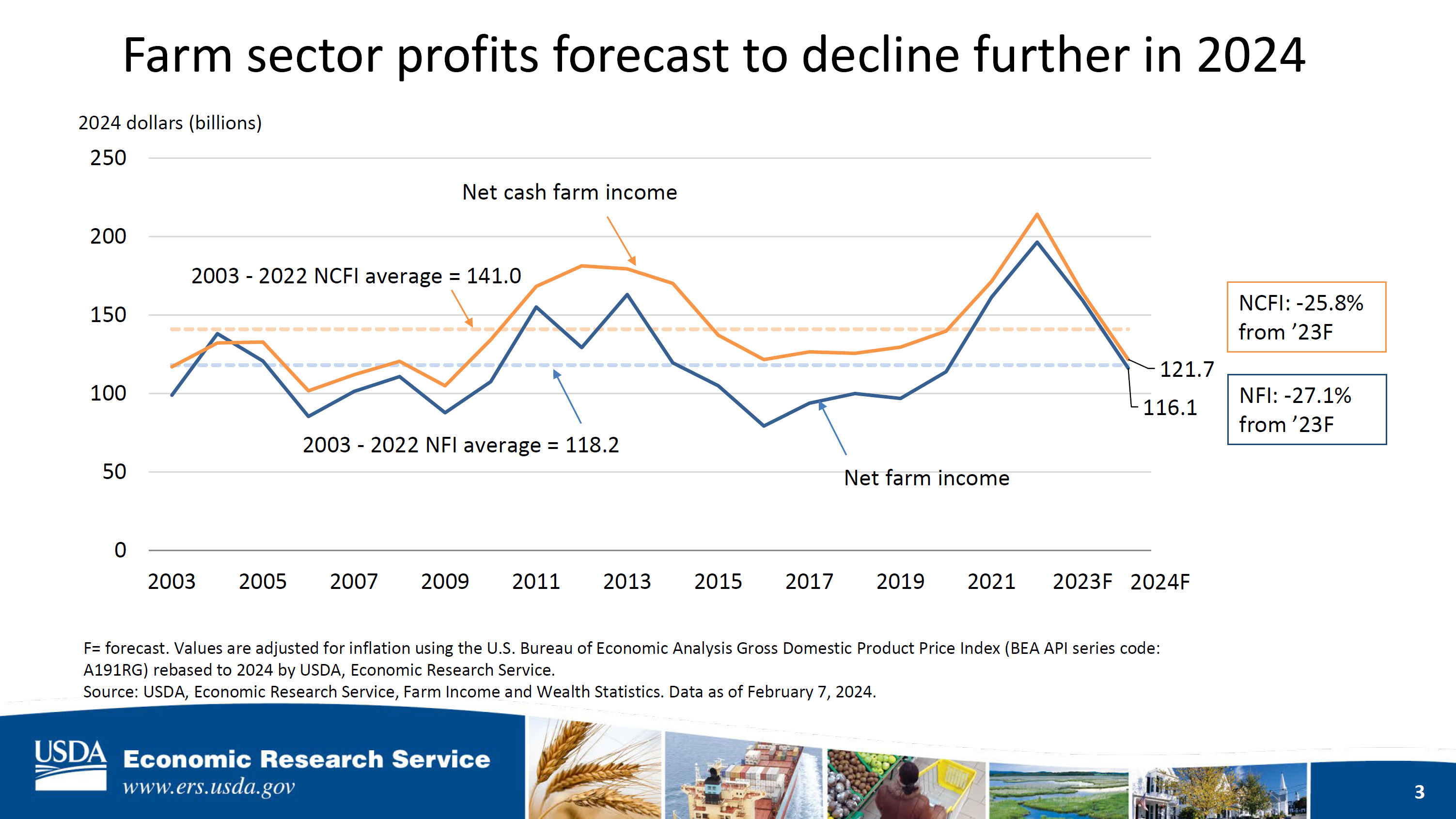

1. Net Cash Farm Income and Net Farm Income forecast to decline in '24

“My caveat to that, it is from what I would call exceptional levels the last two years," says Nate Kauffman, lead economist of the Federal Reserve Bank of Kansas City. "Yes, we’ve got a sharp decline expected maybe in 2024, but it’s coming off of very high levels the years prior.”

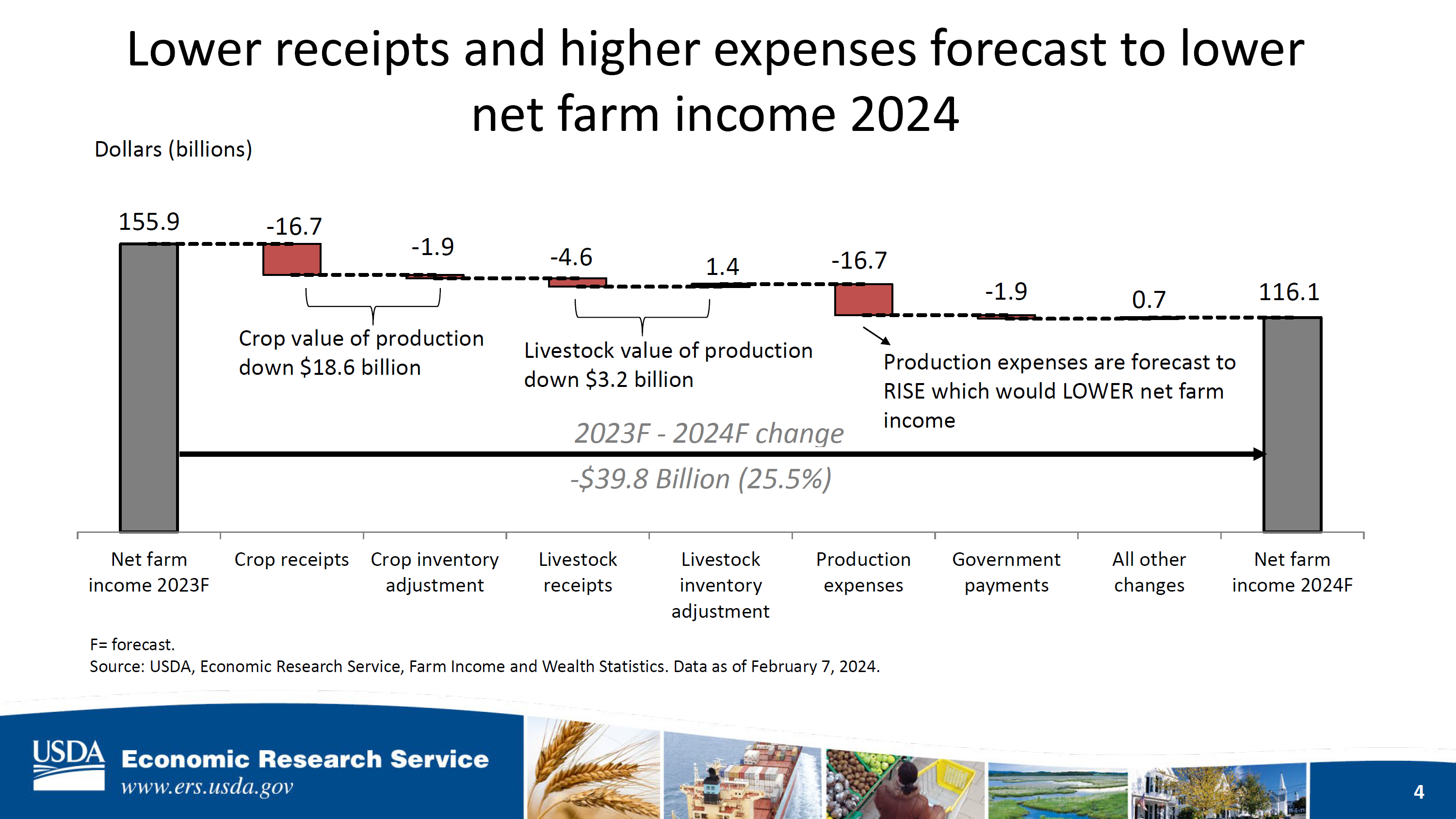

“There are a lot of factors contributing,” says Carrie Litkowski, USDA ERS farm income team lead. “On the far left we have the forecast for net farm income in 2023 at $155.9 billion and at the far right we have the forecast for 2024 at $116.1 billion. So, if we work our way from left to right, crop cash receipts are forecast to decline about $17 billion dollars. When you adjust for changes in inventory the crop value of production is forecast to fall $18-19 billion dollars in 2024.

She continues, “Next, livestock or animal and animal product receipts are forecast to fall $4.6 billion, production expenses, those are expected to rise $16.7 billion. Those are shown as a negative here because we subtract out expenses in the calculation of net income. Next, government payments are forecast to fall almost $2 billion dollars.”

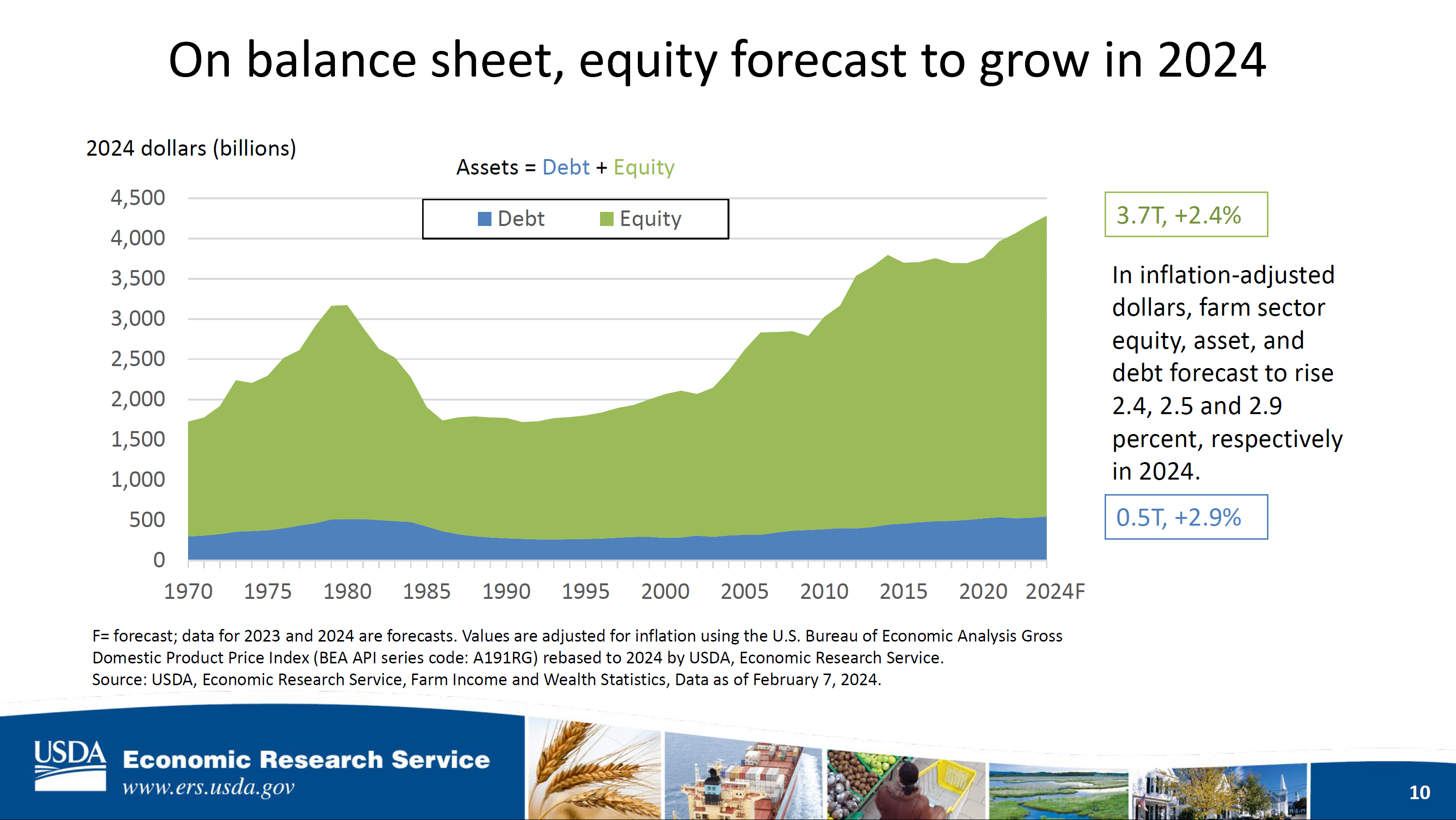

2. Farmer balance sheets show resilience

“Despite expecting two years of lower income, the balance sheets remain relatively strong,” Litkowski says. “Equity is forecast to continue to grow into 2024 largely reflecting increases in real estate assets, that’s the value of land and buildings. Debt, we saw the first decline in debt since 2012 in 2022 but since then, debt has continued to grow and we expect it to continue to grow in 2024, largely reflecting increases in real estate debt.

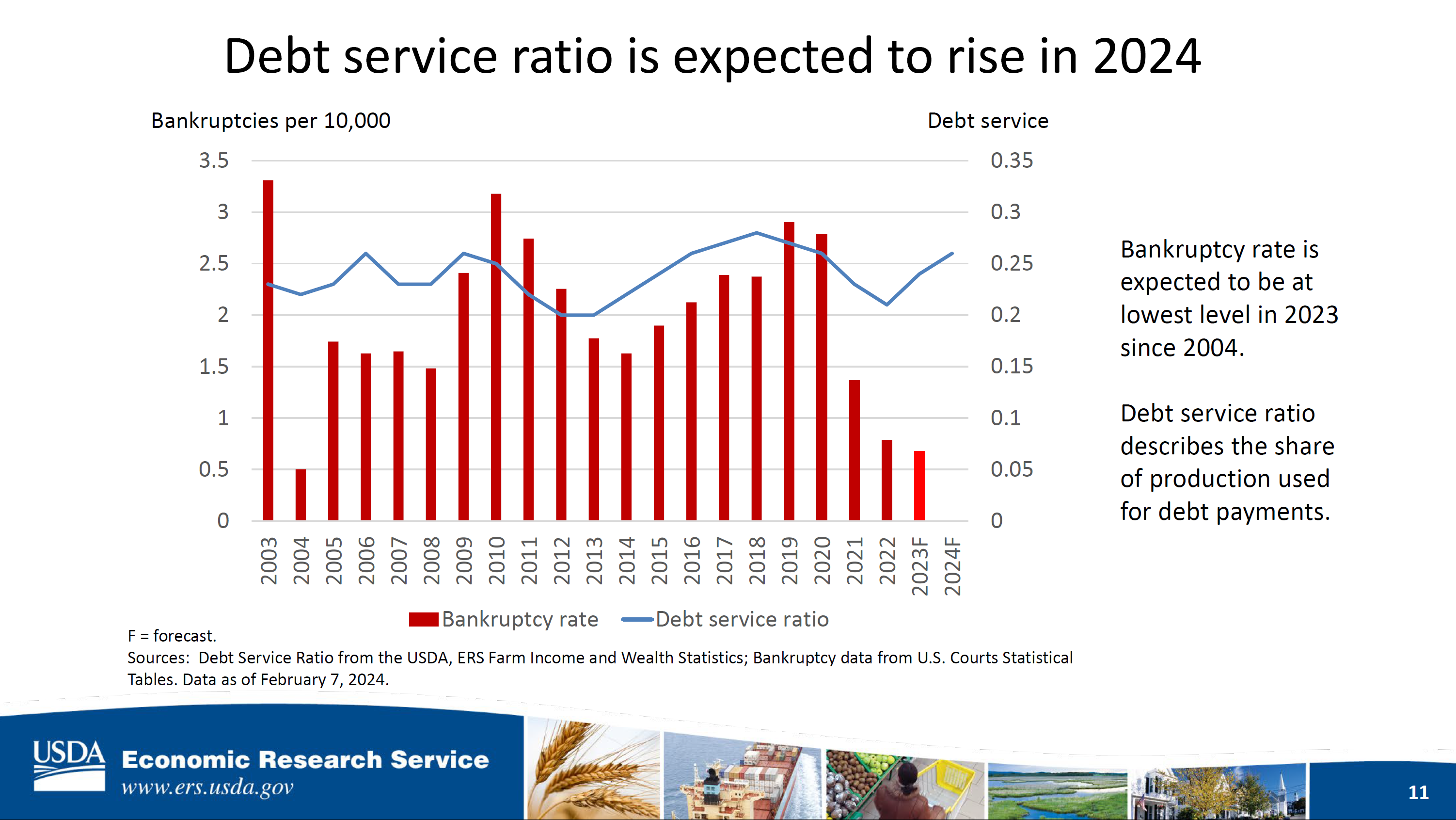

She adds, “There are a number of things we can look at when we’re trying to gauge the financial stress within the industry. The bankruptcy rate, they fell significantly in 2021 and there was less than one bankruptcy per 10,000 farms in 2022 and 2023. The debt service ratio, that’s the amount of production income that has to go towards servicing debt or making debt payments or interest expenses. This had been trending down, but we are forecasting that will increase in 2023 and 2024 largely due to the declines that we’ve been seeing in cash receipts as well as higher interest expenses in recent years.”

“I would argue that many producers, are still despite this expected decline in farm income, in a very very strong financial position," says Kauffman. "Much of this has to do with storing up working capital during these past couple of years when incomes were very strong. … We interact a lot with bankers and other lenders and in some of our conversations with bankers last year we would have banks tell us they actually do not have any borrowers on a watch list. And that is not common to have no borrowers on watch list as it relates to potential risk. So the risk that was inherent in ag production was just simply not there. Now that’s not true everywhere, ... that’s an oversimplification but just saying that to note that conditions have been very strong.”

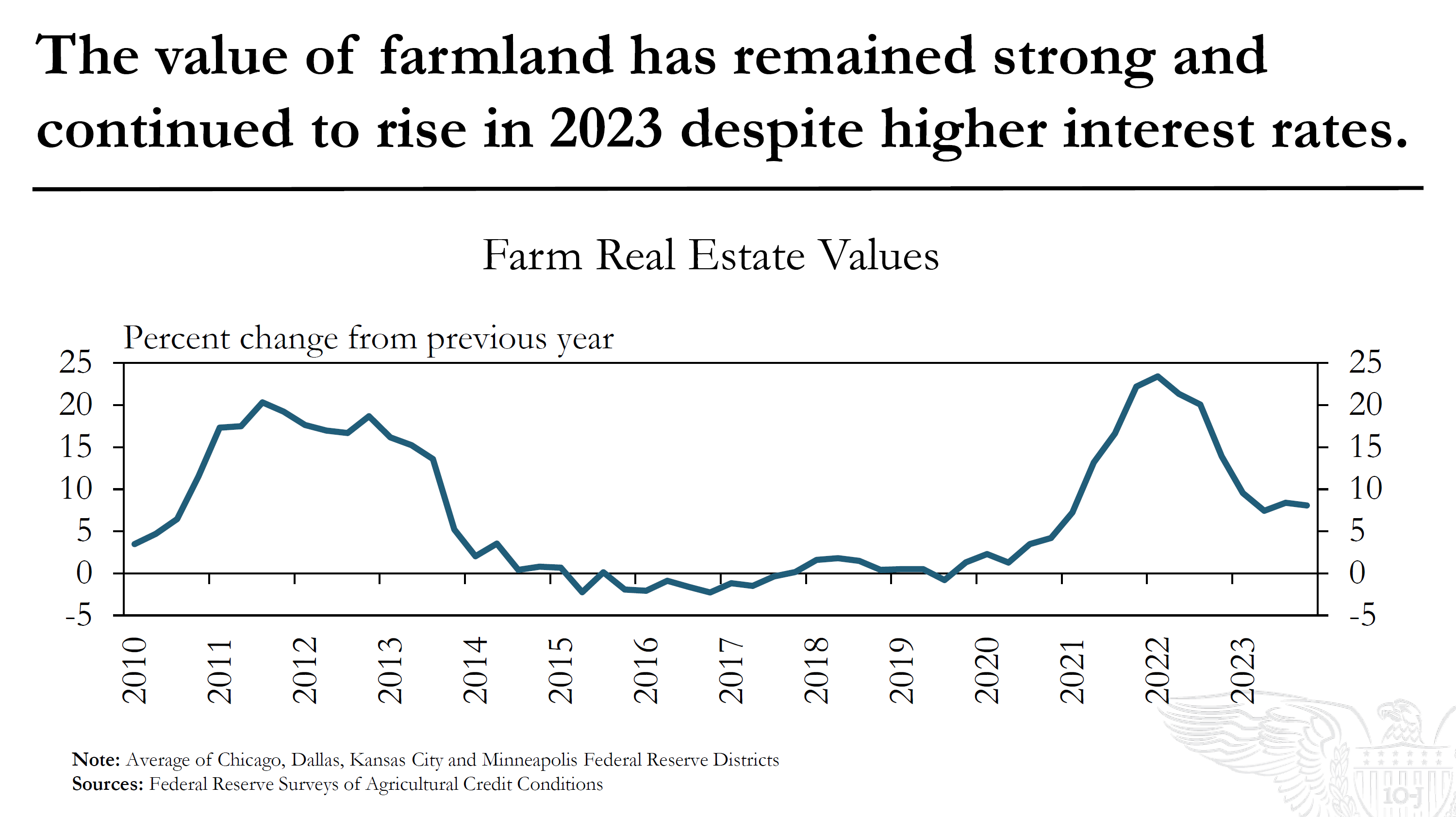

3. Farmland values remain strong

"The Federal Reserve has increased interest rates by five to five-and-a-quarter, five-and-a-half percentage points in the past two years and other interest rates have increased by a similar magnitude," says Kauffman. "Land values were still up almost 10% last year. Continuing to see gains in land values to a large extent coming because producers still had cash coming off very good years, in some ways some of the investment climate has softened a little bit, but there has still been money to purchase farmland that has kept land values strong. Looking ahead we expect that there could be some pressure on this market. That would be my expectation looking at interest rates that are still quite high in comparison to recent years on top of now lower commodity prices and expectations of lower income. What’s holding things up is the overall strength of the financial strength of producers coming into this over the past three years."

Back